Compensation payments: Avoiding contribution issues

Superannuation fund trustees who receive compensation from financial institutions and insurance providers must consider how receipt of these payments may impact a member’s contribution caps.

A superannuation fund may have a right to seek compensation if it entered into a legal contract or agreement with a financial services provider or insurance provider, paid the fees or premiums from the fund’s assets, allocated the cost to the members, and:

■ the financial service or advice was not provided

■ the advice was deficient, or

■ the insurance premiums for death or disability insurance cover were overcharged.

The compensation may include an amount reflecting a refund or reimbursement of adviser fees and/or an amount to compensate for lost earnings. It may also include an interest component.

If a superannuation fund receives such compensation, the fund’s trustee must be aware of possible superannuation, income tax and GST consequences for the fund.

The implications for the fund and members

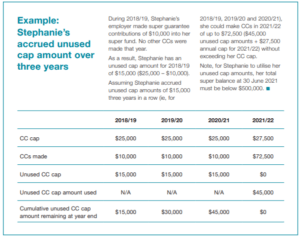

The ATO has released a superannuation contribution caps factsheet that explains how the receipt of compensation payments to a superannuation fund may impact contribution caps.

Whether compensation is a contribution will depend on the circumstances in which the compensation is received.

The circumstances are summarised in the table below:

Knock-on effects for members

The following issues should also be considered by superannuation fund members who have received compensation payments:

■ If the payment results in the member exceeding their concessional or non-concessional contribution cap, the member can apply to the ATO to request the Commissioner to exercise their discretion to disregard the excess contributions or reallocate them to another year.

■ The ATO is unlikely to exercise its discretion if the compensation is paid to the member and the member contributes it to their superannuation fund, or the member directs the financial service provider to pay the compensation to their superannuation fund for their benefit. This is because making the contribution to superannuation is in the member’s control.

■ If a compensation payment is a non-concessional contribution and causes the member to trigger the bring-forward rule, although the member may not exceed the cap in the first year, it could cause problems in the second or third years of the bring-forward period. Where the member subsequently makes a contribution in the second or third years that results in the member exceeding their cap, the ATO has stated there would have to be special circumstances in relation to that contribution made in the later year for it to exercise its discretion.

■ If the compensation payment is a concessional contribution, there may be Division 293 tax consequences if the member’s combined income and concessional contributions exceed the income threshold for the financial year they receive the contribution. From 1 July 2017, the Division 293 threshold is $250,000.

Further information can be found on the ATO website (QC 59706).

Home as a place of business during COVID: CGT implications

The COVID-19 pandemic has resulted in more employees working from home than ever before. This, in turn, has resulted in such people being able to claim a range of deductions for various “running expenses” associated with working from home. These expenses include electricity, phone service, cleaning, decline in the value of equipment, furniture and furnishing repairs, and so on. To make things easier, the ATO even provided several “short-cut” options to claim “working from home” expenses (as opposed to claiming the relevant proportion of the actual costs).

In addition, many people who operate a business (eg, as a sole trader or in partnership) have been required to use part of their home as a place of business – or may have been doing so for many years anyhow.

They, too, are entitled to claim various “running expenses” associated with working from home.

Moreover, if part of the home has the character of a place of business and is set aside as such, then such persons would generally also be able to claim a portion of occupancy expenses (such as mortgage interest or rent, council rates, land taxes, house insurance premiums) in addition to running expenses. This is because part of the home is an asset that is used in carrying on their business. However, where part of a home is being used as a business to generate assessable income, the homeowner will not be able to sell their home CGT-free. Instead, a partial CGT main residence exemption will apply on the basis that part of the home has been used to produce assessable income (in the same way it would apply if part of the home had been rented at arm’s length).

The rules for calculating a partial CGT main residence can be difficult to apply – particularly in determining the appropriate apportionment and correctly applying any exclusions. A professional’s expertise here is invaluable.

More importantly, in cases where a partial exemption may apply because of part-business use of a home, then the CGT small business concessions may be available to eliminate, reduce or roll over any assessable capital gain. The ATO accepts this as being possible:

“You may be able to apply one or more of the small business CGT concessions to reduce your capital gain unless the main use of the house was to produce rent.” (See the ATO website at QC 59281.)

However, the CGT small business concessions are difficult to apply at the best of times – let alone in the case where part of a home is used as a place of business. For example, issues may arise as to whether the homeowner meets the basic threshold requirement for the concessions (including the holding period rule), the effect of joint ownership of the home and, in the case of the 15-year exemption, whether the sale of the home (or CGT event) that gives rise to the capital gain is made in connection with the retirement of the taxpayer.

And of course, where a company or trust carries on the business, a crucial issue also arises as to whether the part of the home used in the business qualifies as an active asset, which is required for the CGT small business concessions to apply.

These (and related) issues require the expertise of a tax professional. So if you find yourself in this position, please contact our office to discuss.

Inheriting rental properties jointly a dilemma!

Imagine you’re lucky enough to inherit, say, four post-CGT rental properties from a deceased parent – but what happens when your sibling also inherits a half-share of these?

While you both acquire a very valuable 50% interest across four properties, it’s safe to say that in most scenarios, you’d both rather have a 100% interest in two of them.

CGT triggered

Assuming both siblings desire a 100% interest in two properties each (rather than a 50% interest in four properties), they’re going to have to do a bit of “horse trading” between them. This means that each sibling has to give up their 50% interest in two of the four properties, in exchange for acquiring a 50% interest in the other two properties.

It’s important to note that such an exchange of interests will trigger CGT consequences. This is because the interest exchanged (or disposed of) is a CGT asset with a particular cost base (under the inherited asset rules in s 128-15), and the capital proceeds for this CGT event will be the market value of the interest acquired in another property. However, the benefit of the CGT discount should be available.

Moreover, because none of the properties are a main residence or a pre-CGT dwelling, the full CGT exemption rules in s 118-195 cannot be brought into play.

Even so, there may be a couple of solutions to this problem that allow both siblings to get their desired 100% interest each in two properties – without triggering any CGT consequences.

Solution 1: A broadly written will

If the will’s been written in broad enough terms, the executor could use their power/discretion to treat the properties as a pool of assets that can be divided equally between the siblings (ie, so they can get two each).

While this presents one solution, adjustments may still be required if some of the properties have a greater contingent CGT liability attached to them than others (at least at the time of distribution) – and this would have to be accounted for in some way to keep both siblings happy.

At any rate, this becomes a matter of the interpretation of the will – a complex topic that’s beyond the scope of this article – and other issues relating to trustee powers may need to be factored in.

Solution 2: Section 128-20(1)(d)

Perhaps a better solution (assuming there are no Pt IVA issues) comes from the rule in s 128-20 of the ITAA 1997, which relates to assets in an estate passing to a beneficiary without any CGT consequences.

In particular, the rule in s 128-2091)(d) allows for this to occur on the settlement of a claim by one or more beneficiaries (or other persons) by way of entering a deed for consideration in which they relinquish rights under the will.

Specifically, the rule provides that an asset can pass to a beneficiary under a will:

(d) under a deed of arrangement if: (i) the beneficiary entered into the deed to settle a claim to participate in the distribution of your estate; and (ii) any consideration given by the beneficiary for the asset consisted only of the variation or waiver of a claim to one or more other CGT assets that formed part of your estate.

If this is carried out during the period of administration of the estate, then each sibling could take their 100% interest in two properties without any CGT consequences arising from this sanctioned estate settlement.

Ruling TR 2006/14 (see paragraphs 33-37) also indicates that this is a legitimate way for beneficiaries who are dissatisfied with a will to dispute it and then enter into a deed of arrangement to affect a redistribution of estate assets – without jeopardising the CGT rollover that becomes available upon death.

It’s important to note, however, that recourse to this section first requires that the deed is entered into to settle a claim to participate in the distribution of your estate.

Crucially, in this regard, paragraph 37 of TR 2006/14 states (emphasis added):

“A taxpayer is not required to commence legal proceedings in order to establish, for the purposes of paragraph 128-20(1)(d), that they have a claim to participate in the distribution of the assets of the estate. A claim may be established by a potential beneficiary communicating to the trustee their dissatisfaction with the will”.

The solution to the problem!

And so we have a workable potential solution to this problem, subject to any Pt IVA considerations – if you call inheriting multiple rental properties a “problem”!

There are a range of factors at play when determining CGT on property. Speaking to us will help you to understand the options available to you.

SuperStream deadline fast approaching

SMSF trustees must get ready to process rollovers via SuperStream by 1 October 2021. This means trustees will no longer able to send and receive paper rollover benefit statements and cheques between superannuation funds.

SuperStream requires employers to pay superannuation and send employee information electronically in a standard format. This links the data to the payment by a unique payment reference number.

Many SMSFs may already be SuperStream-ready because SMSF trustees are required to receive employer contributions electronically (including both the amount of the contribution and the contribution information).

The SuperStream changes will impact an SMSF if the members want to:

■ rollover funds to their SMSF

■ rollover funds from their SMSF (ie, when winding up an SMSF), or

■ receive and action certain release authorities, including the first home super saver (FHSS) scheme, more quickly via SuperStream.

To use SuperStream to roll over money to or from an SMSF, an SMSF will need:

1. An electronic service address (ESA) to process electronic rollover requests.

2. An Australian business number (ABN).

3. To ensure SMSF and member details are up-to-date with the ATO, including a unique bank account recorded with the ATO for superannuation payments.

In practice, the 1 October deadline is important for those SMSF members wanting to roll funds in or out of their SMSF as soon as possible. This means SMSF members who do not have any immediate plans to roll funds in or out of the fund still have some time up their sleeve to get SuperStream-ready.

Further information regarding SMSFs and SuperStream can be found on the ATO website (QC 64222).

Christmas and the ATO

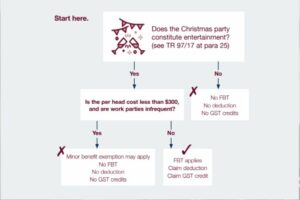

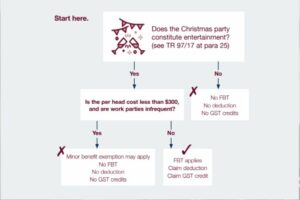

When do employee gifts and celebrations attract fringe benefits tax (FBT)? And when are they exempt?

Christmas is traditionally a time of giving – including employers showing gratitude towards staff for a job well done. However, Christmas parties and gifts can attract the attention of the ATO.

In certain circumstances, an employer can hold a Christmas party for staff and the cost of the party be exempt from Fringe Benefits Tax (FBT).

Take, for example, an employer who holds a Christmas party at a restaurant for employees and their partners and, apart from perhaps the Melbourne Cup, it is the only social function they provide for employees each year. Where this is the case, the party is very likely to be exempt from FBT provided the per-head cost (dinner and drinks) is kept to less than $300 per person. To enjoy this exemption, the employer must use the “actual method” for valuing FBT meal entertainment.

Using the actual method for valuation

The actual method is the default method for valuing meal entertainment FBT and no election is required to use this method. Under this method, an employer pays FBT (in the absence of an exemption) on all taxable meal entertainment provided to employees and their associates, ie, their partners (but not to other parties, such as clients, contractors or suppliers). However, an FBT exemption may apply if the meal entertainment meets the requirements of the minor benefit exemption.

Broadly speaking, under this exemption a benefit will be exempt from FBT where its value or cost is less than $300 and, if similar or identical benefits are provided during the year, they are only provided on an infrequent or irregular basis. The less frequent and regular, the more likely each event will be exempt from FBT.

The 50/50 method

This minor benefit exemption is not available if an employer elects to value their meal entertainment under the less-used alternative 50/50 method. Under this method, the employer pays FBT on only 50% of all taxable meal entertainment provided to employees, associates AND clients, contractors, customers etc. regardless of the cost. Likewise, the employer can only claim a 50% income tax deduction and 50% GST credits on such meal entertainment.

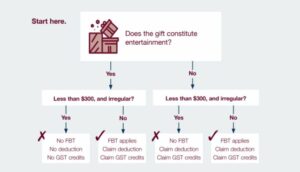

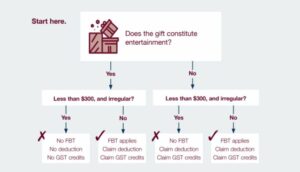

Gifts

If a gift is given at Christmas time and costs less than $300, the minor benefits exemption may be available to exempt from FBT all sorts of common Christmas gifts to employees. This $300 threshold is separate from the Christmas party meal and entertainment threshold.

Non-entertainment gifts to staff (such as Christmas hampers, bottles of alcohol, gift vouchers, pen sets etc) are tax deductible and employers can claim GST credits, irrespective of cost. Note, however, that employers can generally avoid paying FBT if they keep the gift less than $300. If this threshold is exceeded, FBT will apply. Therefore, employers should be conscious of this threshold when providing such gifts to staff this Christmas.

On the other hand, entertainment gifts to staff (such as tickets to movies/theatre/sporting events, holiday airline tickets etc) that are less than $300 will generally not attract FBT, are not income tax deductible, and GST credits on it cannot be claimed. If more than $300, FBT will apply, but a tax deduction and GST credits can be claimed. With the FBT rate at 47%, the tax deduction and GST credits available are unlikely to provide a better tax outcome than avoiding FBT by keeping the gift to less than $300.

For more details on how to navigate FBT and to understand the most tax-effective way to thank or reward employees, please contact our office.

The tax treatment of Christmas parties: the actual FBT method

Click here to view Glance Consultants October 2021 Newsletter via PDF