Compensation from your bank or financial institution – is it taxable?

Unfortunately our financial institutions have not always acted as ethically as we consumers would like.

Whether you’ve received bad advice or paid for advice you didn’t receive at all, our supervisory and regulatory bodies have sought not only to improve the system so it won’t happen again, but also to ensure that if you are on the receiving end of such bad behaviour, you could be entitled to receive financial restitution.

If you’ve recently received a compensation payment, you might be wondering whether you need to pay tax on it.

The answer is – it depends!

It depends on how your investment was held1 and the type of compensation you received.

For example, if you’ve disposed of the investment and previously reported a capital gain in your income tax return, your compensation payment increases the capital gain (you may be able to claim the 50% discount too if you held the investment for more than 12 months). You may need to amend your income tax return to include this additional capital gain.

If you haven’t yet disposed of the investment, and you hold it as a capital investment1, then the compensation payment reduces its cost for when you do dispose of it in the future (make sure keep details of the compensation payment with your tax

records to provide to us later). Where your compensation payment includes an amount that is a refund or reimbursement of adviser fees, and these fees were previously claimed a tax deduction by you, then the amount you received as a refund or reimbursement will generally be taxable to you in the income year you receive it. Similarly, any part of the payment that represents interest should also be included in your tax return in the year you receive it.

If you’ve received an amount of compensation and not sure whether it is taxable, or if you need to amend a prior year tax return for a payment you received, please reach out to us.

Tax issues when dealing with volunteers

From bushfire relief groups, sporting clubs, environmental groups, charity associations and many more, volunteers are an indispensable workforce and support network for many organisations. For most, if not all, having volunteers ready to lend a hand is pivotal in them being able to function or survive.

Given that there are many hundreds of volunteers propping up all sorts of good works throughout the nation, and in the spirit of thorough tax planning, an important practical consideration for many may be if payments to volunteers constitute assessable income and whether their expenses are tax deductible.

WHAT’S A VOLUNTEER?

There is no common law definition of “volunteer” for tax purposes, although it typically means someone who enters into any service of their own free will, or who offers to perform a service or undertaking.

A genuine volunteer does not work under a contractual obligation for remuneration, and would not be an employee or an independent contractor.

Volunteers can be paid in cash, given non-cash benefits or a combination of both – payments include honorariums, reimbursements and allowances. Generally, receipts which are earned, expected, relied upon and have an element of periodicity, recurrence or regularity are treated as assessable income.

Conversely, where a person’s activities are a pastime or hobby – rather than income-producing – money

and other benefits received from those activities are generally not perceived as assessable income.

The examples below shed light on whether typical payments such as honorariums, reimbursements and allowances constitute assessable income.

IS AN HONORARIUM ASSESSABLE INCOME?

An honorarium is either an honorary reward for voluntary services, or a fee for professional services voluntarily rendered, and can be paid in money or property.

Example 1

Q. Alex works as a computer programmer at the local city council and volunteers as a referee for the local rugby union. This year he organised an accreditation course for new referees. He applied for a grant, arranged advertising, assembled course materials, and booked venues. Alex is awarded an honorarium of $100 for his efforts.

A. No, the honorarium is not assessable income as honorary rewards for voluntary services are not assessable as income and related expenses are not deductible.

Example 2

Q. Mindy has an accounting practice and volunteers at the local art gallery. Mindy prepares the gallery’s annual report using her business’s software and equipment.At the gallery’s annual general meeting, Mindy is awarded an honorarium of $800 in appreciation of her services.

A. Yes, this honorarium constitutes assessable income because it is a reward for services connected to her income-producing activities.

IS A REIMBURSEMENT ASSESSABLE INCOME?

A reimbursement is precise compensation, in part or full, for an expense already incurred, even if the expense has not yet been paid. A payment is more likely to be a reimbursement where the recipient is required to substantiate expenses and/or refund unspent amounts.

Example 3

Q. Matthew is an electrical contractor. He volunteers to mow the yard of a local not-for-profit childcare centre. Matthew purchases a $15 spare part for the centre’s mower. The childcare centre reimburses Matthew for the cost of the spare part.

A. No, the $15 reimbursement is not assessable income because Matthew has not made the payment in the course of his enterprise as an electrician.

Example 4

Q. Rose has a gardening business. She volunteers to prune the shrubs of a local nursing home and uses materials from her business’s trading stock.

A. Yes, any reimbursement she receives for the cost of the materials is assessable income because the supplies were made in the course of her enterprise.

IS AN ALLOWANCE ASSESSABLE INCOME?

An allowance is a definite predetermined amount to cover an estimated expense. It is paid even if the recipient does not spend the full amount.

Example 5

Q. Andy volunteers as a telephone counsellor for a crisis centre. He is rostered on night shifts during the week and is occasionally called in on weekends. When Andy works weekends, the centre pays him an allowance of $150. The allowance is paid to acknowledge Andy’s extra efforts and to compensate him for additional costs incurred.

A: Yes, these payments to Andy are considered assessable income because he received the allowance with no regard to actual expenses and there is no requirement to repay unspent money.

EXPENSES INCURRED BY VOLUNTEERS

On the tax deductibility of volunteer expenses, a volunteer may be entitled to claim expenses incurred in gaining or producing assessable income – except where the expenses are of a capital, private or domestic nature.

For instance, expenditure on items such as travel, uniforms or safety equipment could be deductible, but expenses incurred for private and income-producing purposes must be apportioned – with only the income-producing portion of the expense being tax deductible.

Example 6

Q. Robert operates a commercial fishing trawler and uses navigational charts in his business.He also volunteers as an unpaid training officer at the volunteer coastguard. Robert purchases two identical sets of navigational charts – one for his business, the other as a training aid in coastguard courses.

A. Yes, Robert can claim the part incurred in gaining or producing assessable income – in this case, half the total cost.

WHAT ABOUT DONATIONS? ARE THESE DEDUCTIBLE?

It is also common for volunteers to donate money, goods and time to not-for-profit organisations. To be tax deductible, a gift must comply with relevant gift conditions, and:

■ be made voluntarily

■ be made to a deductible gift recipient, and

■ be in the form of money ($2 or more) or certain types of property.

Donors can claim deductions for most, but not all, gifts they make to registered deductible gift recipients. For instance, a gift of a service, including a volunteer’s time, is not deductible as no money or property is transferred to the deductible gift recipient.

However, individuals may be entitled to a tax deduction for contributions made at fundraising events, including dinners and charity auctions.

Example 7

Mila buys a clock at a charity auction for $200. This is not a gift even if Mila has paid a lot more than the value of the clock. Payments that are not gifts include those to school building funds as an alternative to an increase in school fees and purchases of raffle or art union tickets, chocolates and pens.

Example 8

Clive receives a lapel badge for his donation to a deductible gift recipient. As the lapel badge is not a material benefit or an advantage, the donation is a gift.

Consult this office for more information on which volunteer payments are considered assessable income and which expenses are typically tax deductible.

Collectables – and inherited jewellery

Collectables

Capital gains tax does not just apply to “big ticket” items such as real estate, farms and shareholdings. It also applies to a special class of assets known as “personal use assets” and, in particular, those personal use assets known as “collectibles”.

“Collectables” are specifically defined under the tax law to mean the following items that are “used or kept mainly for your personal use or enjoyment”:

■ artwork, jewellery, an antique, or a coin or medallion; or

■ a rare folio, manuscript or book; or

■ a postage stamp or first day cover.

However, for an asset to be a collectable, it must have cost more than $500. Otherwise, collectables acquired for $500 or less are exempt from CGT (but subject to important rules to get around or avoid this threshold test).

However, the most important rule about a collectable is that if you make a capital loss on selling or disposing of a collectable, that capital loss can only be offset against capital gains from other collectibles.

It cannot be offset against the capital gain from, say, shares or real estate, and nor can it be offset against your other income.

Furthermore, that jewellery you inherit from your mother will retain its “character” as a collectable (if it was acquired by her after 20 September 1985). So, this too is something to be aware of.

Personal use assets

As for “personal use assets” per se (ie assets used for personal use or enjoyment which are not “collectables” – such as furniture, clothing, pianos etc) they are only subject to CGT if they cost more than $10,000. More importantly, however, is that you cannot claim a capital loss made on a personal use asset.

But is it a business?

Finally, of course, it is often the case that a person who owns such collectibles does so for the purpose of trading in them. In this case, the CGT rules take a backseat to the fact that the profit from such activities is assessable in the same way as ordinary income, as if you were operating a business.

If you find yourself dealing with such items, it is necessary to get good tax advice on the matter.

Using super to pay the mortgage

Have you reached preservation age and still have a mortgage? If so, you may be able to use your super to deal with your rising mortgage repayments if you meet certain conditions.

Introduction

The constant increase to interest rates over the last two years have left some borrowers strapped for cash. Fortunately, those that have reached preservation age can access their superannuation via a special type of pension, known as a transition to retirement (TTR) pension, even if they haven’t retired.

What is preservation age?

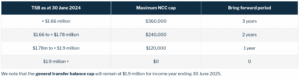

Your preservation age is the earliest age you can access your superannuation. The preservation age that applies to you depends on your date of birth and ranges from age 55 to 60, as shown in the table below.

Alternatively, you will also reach preservation age when you reach age 65, even if you are still working.

What is a TTR pension?

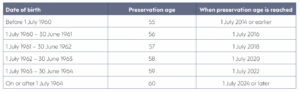

A TTR pension allows you to supplement your income by allowing you to access some of your superannuation once you’ve reached your preservation age. You can start a TTR pension by transferring some of your superannuation to an account-based pension (ABP), which is a regular income stream bought with money from your superannuation fund.

Once you start a TTR pension, you need to withdraw payments between a minimum and maximum range each year. The minimum drawdown rate depends on your age and is 4% for those under 65 years old. The maximum amount you can withdraw is 10% of your account balance as at 1 July of each financial year (or 10% of the value from the date your TTR pension started in that financial year). This means you can choose pension payments anywhere between your minimum and maximum payment limit each year.

But note that a TTR pension does not allow you to withdraw your superannuation as a lump sum. This can generally only be done once you’ve reached your preservation age and met certain conditions of release, such as retirement.

Example

Justine is 60 years old and has $650,000 in superannuation. Justine’s adviser recommends she commences a TTR pension with $600,000 to help ease her financial difficulties. Justine must draw a minimum of $24,000 (ie, 4% x $600,000) or up to a maximum of $60,000 (ie, 10% x $600,000) in pension payments in the 2023-24 financial year.

Justine can use the additional TTR pension payments to help supplement her employment income and meet her mortgage repayments. She could also use a TTR pension as a strategy to pay down her mortgage much quicker than planned even if she could easily afford her repayments.

Factors to consider

■ If you are 55 to 60, the taxable amount of your income from your TTR pension is taxed at your marginal tax rate, less a 15% tax offset.

■ Once you turn 60, your TTR pension payments are all tax free.

■ Any investment earnings generated from your TTR pension are subject to the same maximum 15% tax rate as superannuation accumulation funds.

■ Once you reach age 65 or retire, your TTR pension will automatically convert to an ABP. This means more flexibility as the 10% maximum pension limit will no longer apply.

Need help?

You should seek financial advice before deciding if a TTR pension is right for you as it could help you understand the possible benefits and implications for your particular circumstances.

TIP

If you commence a TTR pension halfway through the year, the minimum payment percentage is pro-rated to reflect the number of days the pension is in place in that first financial year. The minimum will be recalculated at 1 July based on your TTR pension balance and your age at that time to factor in a whole year’s worth of pension payments.

Returning to work after retirement

Most people look forward to retirement as it is a chance to finally take time to relax, enjoy life and do things they never had time for when they were working. But sometimes things change and some people feel the urge to return to work. If a return to work is inevitable, it is important to understand the superannuation retirement rules when it comes to working and accessing your superannuation.

Introduction

Many new retirees find that after a few months the novelty of being on ‘permanent vacation’ starts to wear off. Some people may miss their sense of identity, meaning, and purpose that came with their job, the daily structure it brought to their days, or the social aspect of having co-workers.

In fact, figures from the Australian Bureau of Statistics (ABS) have revealed financial necessity and boredom are the most common factors prompting retirees back into full or part-time employment1. As such, it is not uncommon to want to return to work after retirement, even if only on a part-time or casual basis. Whatever your reasons or motivations might be, there are a range of factors to consider if you wish to return to work depending on your age.

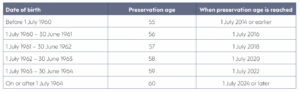

There are three ways in which you can retire, access your superannuation and then return to work, which are summarised below.

1. Retire on or after reaching preservation age

Individuals can retire after reaching their preservation age2, ending gainful employment and declaring that they intend never to return to any ‘gainful employment’ for 10 hours or more each week.

It is illegal to access your superannuation with a false declaration of intention so your intention to retire must be genuine at the time. This is why your superannuation fund may require you to sign a declaration stating your intent.

That said, you can return to work while still accessing your superannuation as long as your intention to retire at the specific time was genuine and that you didn’t plan to return to work all along. Your intentions are allowed to change even though you may have retired and have already accessed your superannuation or are receiving age pension payments.

2. Ceasing an employment arrangement after age 60

From age 60, you can stop an employment arrangement (ie, resign from a job) and obtain full access to your superannuation without having to make any declaration about your retirement or future employment intentions.

If you are in this situation, you can return to work without any issues because there was no requirement for you to declare your retirement permanently. For example, you could resign from a job with one employer and start work with a different employer and access your superannuation.

3. Retire after age 65 or older

Once you turn age 65, you can access your superannuation regardless of your work status and do not need to make any declaration about your retirement status. You only need to be retired if you want to access your superannuation before you turn age 65.

Whether you are accessing your superannuation or not, you can return to work at any time.

Your super after returning to work Regardless of what age category you fall into, you may have taken your superannuation as a lump sum, income stream or a combination of both. If your circumstances change and you return to work, any amounts in your superannuation fund, including any pension payments you may be receiving will remain accessible and can continue to be paid.

However upon recommencing any future employment, any future superannuation contributions and earnings from subsequent employment and any voluntary contributions will remain preserved until a further condition of release is met, such as retirement or reaching age 65.

Impact on age pension

If you are receiving the age pension and decide to return to work, your employment income will count towards Centrelink’s income test which may impact your age pension entitlements.

Having said that, Centrelink has a ‘Work Bonus’ scheme which reduces the amount of your employment income, or eligible self employment income, which Centrelink applies to your rate of age pension entitlement under the income test.

Fortunately, you don’t need to apply for the Work Bonus, rather Centrelink will apply the Work Bonus to your eligible income if you meet all the eligibility requirements. All you need to do is declare your income.

If your intentions or circumstances have changed and you have decided that you would like to return to work, contact us if for a chat about your options.

Click to view Glance Consultant’s February newsletter via PDF

1 ABS – Retirement and Retirement Intentions, Australia, released 29/8/2023

2 Refer to ‘Using super to pay the mortgage’ article for more information on preservation age