In the May 2019 Federal Budget, the Government announced that Single Touch Payroll (STP) would be expanded to include additional information, building on the first stage of STP which was made compulsory for most employers from 1 July 2019.

For background, the STP regime is a government initiative which is designed to reduce an employer’s burden when reporting to Government agencies such as the ATO. Under the regime, employers report employee payroll information to the ATO each time they are paid via STP-enabled software.

Start date

The start date for Phase 2 reporting was 1 January 2022, however the ATO has advised that employers who provide the additional reporting required under Phase 2 by 1 March 2022 will be accepted as having met the deadline. Digital service providers (DSPs) can apply for a deferral if they need more time to make changes and update their solutions. Such a deferral then automatically applies to customers of that provider. For example, Xero have advised that they have been granted a deferral until 31 December 2022. This means that all customers using Xero Payroll will also have until that date to report their first STP Phase 2 pay run. Check with your provider if a deferred start date applies. For businesses that need more time to transition, you may apply for an extension beyond your software provider’s deferral. Registered accountants and bookkeepers will also be able to apply on your behalf. On the compliance front, under Phase 2, genuine reporting mistakes will not be penalised in the first year until 31 December 2022.

ATO: Benefits for employers

1. TFN Declarations Employers will no longer need to send employee TFN declarations (they will still need to be collected and filed in employee records, however).

2. Closely held payees For businesses using concessional reporting, such as is the case for closely held payees, this can be communicated through income types.

3. Lump Sum E Payments When making Lump Sum E payments, employers won’t need to provide Lump Sum E letters to employees.

4. Payroll Data Integrates with Services Australia Payroll information employers provide to the ATO will be shared in near real-time with Services Australia, who can use it to streamline requests.

What isn’t changing?

- The way you lodge, pay and update events

- The due date for lodging events The types of payments that are needed

- Tax and super obligations

- End of financial year finalisation event requirements

In practice Once your STP 1 solution is upgraded to offer phase 2 reporting, you can transition at any time throughout a financial year. The way you transition from STP 1 to STP Phase 2 reporting will depend on your circumstances and the solution you use.

Warning: STP 2 is not just a software upgrade

The sheer volume of additional data is perhaps the most notable feature of STP 2. Phase 2 requires employers to develop an understanding of what data is required, in the multitude of STP 2 labels and codes in order to properly drive STP 2 software. All told, there are 16 new reporting labels and approximately 100 different codes and reporting options. STP2 reported data will help shape employee social security, Child Support Agency and income tax outcomes. It may the case that the complexities around STP 2 will be too great for many small business owners, and they will need input of their accounting or bookkeeping advisor.

You should follow your digital service provider’s instructions to upgrade your solution.

Checklist

- Commence reporting from 1 March 2022

- No penalties for genuine mistakes apply until the start of 2023; the main thing is to commence reporting

- Consult with your existing STP 1 provider about the transition to STP 2

- Seek input from our office around the reporting itself.

Consolidate your super

Did you know that there are approximately 10 Things to consider before consolidating million unintended multiple super accounts, which represents around 35% of all member accounts held by funds?

While in some cases this outcome may be intended, more often than not the creation of multiple accounts is unintended and mainly occurs when employees change jobs and do not nominate the same (or any) account for their super guarantee to be paid into.

These multiple super accounts are costing Australians an extra $690 million in duplicated administration fees and $1.9 billion in insurance premiums per year, which is eroding many Australians’ hard earned super benefits.

If you are one of these individuals with multiple super accounts, there may be benefits to rolling your accounts onto one super fund.

The benefits of consolidating funds

There are a number of benefits of rolling your accounts into one fund, including:

■ Prevent duplicated fees – having one super fund means one set of fees, potentially saving you hundreds and thousands of dollars over your lifetime.

■ Easier to manage – having all your super in one account makes it easier to manage as there is less paperwork and administration to worry about.

■ Maximise your investment returns– once you have consolidated your funds, it will be easier to manage your investment strategy and you’ll be able to maximise the funds to invest.

Things to consider before consolidating

Before you consolidate your funds, there are a few things you should consider, including:

■ Check whether you have any insurance cover – you may hold life, total and permanent disability cover and income protection through your super funds. When changing funds, you may lose this cover or not receive the same level of cover in the new fund. Individuals with pre-existing medical conditions and those aged over 60 need to be particularly vigilant.

■ Compare your super funds – it is important to compare your super funds to check on things like fees, insurance premiums, variety of investment options available, performance data, etc before you choose a super fund that meets your needs.

■ Check if you can rollout of your current fund – it may not be possible for you to transfer your money out of your account eg, if you have a defined benefit fund.

Speak to your licensed financial advisor to help you make the right decision, particularly if you’re not sure about the adequacy of your new or existing insurance coverage.

HOW TO CONSOLIDATE

Consolidating your super is now easier than ever, using ATO online services or your myGov account. If you’re not sure whether you might have other super accounts, you can also search for lost or unclaimed

super via the ATO or by logging into your myGov account linked to the ATO and clicking on Manage my super.

What does Temporary Full Expensing (TFE) of assets mean for me?

As Australia looks to get back to work and continue its recovery, the Temporary Full Expensing (TFE) measures are available to support business and encourage investment. Eligible businesses can claim an immediate deduction for the business portion of the cost of most assets in the year they are first used or installed ready for use.

Businesses (in this case with an aggregated turnover less than $5 billion) can deduct the full cost of eligible assets acquired after 6 October 2020 (Budget night) in the 2020-21 and 2021-22 income years. Legislation is currently before Parliament to extend this to the 2022-23 income year as well. Small businesses that use the simplified depreciation rules will also claim a deduction for the balance in their small business pool during this time.

Can I deduct any assets?

There are some assets that are excluded from the TFE measures, the main ones being:

■ certain assets in low-value or software development pools

■ capital works (building improvements) that are deducted under Division 43, and second-hand assets used to produce income from residential property

■ Primary production assets that fall under Subdivision 40-F and 40-G and horticultural plants

■ assets leased on long term hire arrangements

■ trading stock and CGT assets, and

■ assets not used or located in Australia.

How does it work?

Consider the following example of a tour bus business:

On 1 February 2021 it purchases a coach for $160,000. The business can claim the entire amount as a deduction under TFE.

In March 2021 it constructs a customer wait lounge at its office for $50,000. Because the expenditure is on capital works, the business can’t claim a deduction under TFE (it will be subject to a claim under Division 43 instead).

On 15 April 2021 it incurs $10,000 while improving an existing depreciating business asset. The business can claim a deduction for these costs under TFE.

On 20 June 2021 it purchases a work vehicle (SUV) for $65,000 which will be used solely for business use. This asset is eligible for TFE, but the deduction will be subject to the car limit ($59,136 in the 2020-21 income year). The excess is not available as a tax deduction.

This is in contrast to the earlier example where a $160,000 coach was purchased. Such a vehicle is not a car for depreciation purposes and therefore a full deduction can be claimed because it is not subject to the car limit.

At the end of the 2020-21 income year, it had a balance in its small business pool of $100,000.

The business will deduct the balance of the pool under TFE.

What’s my benefit?

As these examples show, the brought-forward deductions available under TFE can be substantial. It’s important to note though, that the main benefit to businesses of TFE is one of timing. It brings forward the deduction on assets that would normally be spread over several years. This means the business may pay less tax, or no tax, now (but more in the future). All told, the immediate benefit is that TFE can assist cash flow.

The business can then potentially use that extra cash flow to make further investment or support operations.

We note that it is possible for some businesses to opt out of TFE (for example, for a number of reasons, it may not be advantageous from a tax perspective to generate substantial tax losses that TFE may generate).

Ultimately, any decision to opt out will usually rest with you and your accountant.

Topping up your concessional contributions

Thinking about making up for lost time and making extra contributions to top up your super? The good news is that the “catch-up” concessional contribution (CC) rules can help individuals who feel they have missed out on building their retirement savings to make extra before-tax contributions.

Remember, CCs can include super guarantee contributions from your employer, salary sacrificed amounts and tax-deductible personal contributions.

What are catch-up CCs?

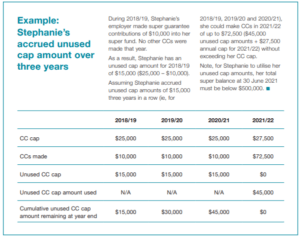

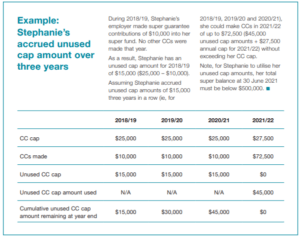

You can carry forward any unused CC cap amounts that have accrued since 2018/19 for up to five financial years and use them to make CCs in excess of the general annual CC cap (currently $27,500 in 2021/22).

You can then make a CC using the unused carry forward amounts provided your total super balance at the end of the previous financial year is below $500,000.

Once you start to use some of your unused cap amounts, the rules operate on a first-in first-out basis.

That is, any unused cap amounts are applied to increase your CC cap in order from the earliest year to the most recent year. So, when you use some of your unused cap from prior years, the unused cap from the earliest of the five-year period is used first. And remember, if you don’t use your accrued carry forward amounts after five years, your unused cap amounts will expire. So it’s best to use it before you lose it! (See example overleaf.)

Who can benefit from catch-up contributions?

Catch-up contributions may assist individuals who:

• Previously couldn’t afford to make additional contributions

• Have spent time out of the workforce to study, look after children or elderly family members

• Work part-time or are casual employees

• Have interrupted or non-standard work patterns (ie, self-employed people)

• Dispose of an asset and want to reduce their tax and further maximise their contributions to super

• Receive a windfall/inheritance and want to contribute the funds to super.

If you finally have capacity to make extra contributions and want to build your super, utilising the catch-up CC rules can allow you to make up for lost time and be an easy way boost your super for retirement

Your Business Structure

At the start of each year, business owners typically review their affairs, including at times their trading structure. Others may be going into business and choosing their initial structure. There are four main business structures – sole trader, company, trust, and partnership (or a combination of these).

Sole trader

This is how many businesses commence. Under this structure, an individual operates the business and is liable for all aspects of the business including income, debts and losses. These can’t be shared with any other individual.

Advantages of this structure include simplicity, and minimal set up or ongoing costs.

Disadvantages include personal liability, and also an inability to take on a business partner, noting however that as a sole trader you can still employ workers.

Company

Here, the directors (and mainly in the case of small businesses, shareholders) run the business. The company itself pays tax on the income at a reasonably low company tax rate of 25%, though directors can be personally liable for tax if they are caught by the personal services income (PSI) rules.

These rules can come in to play where the business income is a result of your personal effort, expertise or skills. Subject to any personal guarantees or any director penalty notices being issued, companies provide asset protection for the owners, potential legal tax minimisation, they easily allow the admission of new business partners, and they can trade anywhere in Australia.

On the downside, companies are not eligible for the 50% CGT discount, are highly scrutinised and regulated, and are reasonably expensive to establish, maintain and wind up.

Trust

This is quite a common business structure whereby the trustee holds your business on trust for the benefit of the beneficiaries (usually the business owners, but can include other parties such as family members, companies etc). The trustee can be a person or a company and is responsible for the operation of the trust including compliance with its deed. In practical terms, the beneficiaries pay tax on the trust income that they receive from the trust at their own tax rate. Note however that trust income may be caught by the PSI rules, see earlier The advantages of a trust include asset protection (even more so when there’s a corporate trustee), potential legal tax minimisation, and for family trusts compliance is relatively straightforward. On the downside, trusts can be complex, costly to establish, and on the tax front losses are trapped inside the structure and can only be used to offset future income.

Trusts are also a strong focus of the ATO.

Partnership

A partnership is a group or association of people who carry on a business and distribute income or losses between themselves (between two and up to 20 people). The partners themselves are liable for tax on

the income from the partnership commensurate with their share of the partnership, however this is again subject to the PSI rules – see earlier. The losses and control of the business are also personally shared.

Partnerships are governed by a partnership agreement which should be in writing and deal with all aspects of how the partnership operates.

Some of the advantages of operating a partnership is that they are easy to understand, reasonably inexpensive to set up and maintain, and other individuals can easily be admitted. On the other hand,

there is no real asset protection, in that each partner is ‘jointly and severally’ liable for the partnership’s debts (that is, each partner is liable for their share of the partnership debts as well as being liable for all the debts). Each partner is also an agent of the partnership and is liable for actions by other partners.

Closing comment

Aside from tax, there are many factors to consider when determining the best structure for your business, including ease of understanding, set up and compliance costs, the ability to admit new owners, asset protection etc.

You can change your business structure at any time, however there may be costs involved such as capital gains tax and stamp duty. Contact our office if you are considering changing your structure or if you are going into business and choosing your initial structure.

Click here to view Glance Consultants February 2022 Newsletter via PDF