The JobKeeper extension has passed — There will be important changes to the wage subsidies. Here’s what you need to know.

There are two separate extension periods. For each extension period, an additional actual decline in turnover test applies and the rate of the JobKeeper payment is different.

The extension periods are:

- Extension 1: from 28 September 2020 to 3 January 2021

- Extension 2: from 4 January 2021 to 28 March 2021

The rates of payment will change

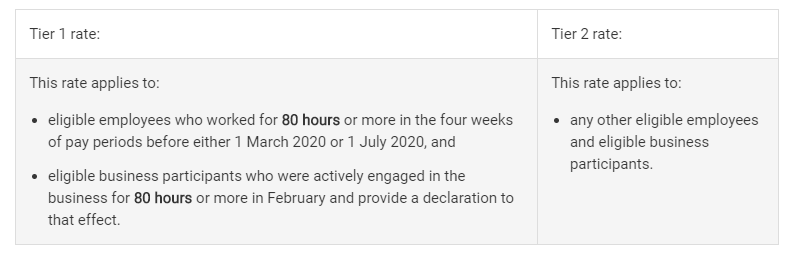

The rate of the JobKeeper payment in each extension period will depend on the number of hours:

- an eligible employee works, or

- an eligible business participant is actively engaged in the business.

It will be split into two rates.

Employers and businesses will need to nominate the rate they are claiming for each eligible employee and/or eligible business participant.

JobKeeper extension 1

This extension period will run from 28 September 2020 to 3 January 2021.

You will need to show that your actual GST turnover has declined by 30% or more in the September 2020 quarter relative to a comparable period (generally the corresponding quarter in 2019).

The rates of the JobKeeper payment in this extension period are:

- Tier 1: $1,200 per fortnight (before tax)

- Tier 2: $750 per fortnight (before tax).

JobKeeper extension 2

This extension period will run from 4 January 2021 to 28 March 2021.

You will need to show that your actual GST turnover has declined by 30% or more in the December 2020 quarter relative to a comparable period.

You can be eligible for JobKeeper extension 2 even if you were not eligible for JobKeeper extension 1.

The rates of the JobKeeper payment in this extension period are:

- Tier 1: $1,000 per fortnight (before tax)

- Tier 2: $650 per fortnight (before tax).

What you need to do

From 28 September 2020, you must do all of the following:

- work out if the tier 1 or tier 2 rate applies to each of your eligible employees and/or eligible business participants and/or eligible religious practitioners

- notify us and your eligible employees and/or eligible business participants and/or eligible religious practitioners what payment rate applies to them

- during JobKeeper extension 1 – ensure your eligible employees are paid at least

- $1,200 per fortnight for tier 1 employees

- $750 per fortnight for tier 2 employees

- during JobKeeper extension 2 – ensure your eligible employees are paid at least

- $1,000 per fortnight for tier 1 employees

- $650 per fortnight for tier 2 employees.

What doesn’t change

To claim for fortnights in the JobKeeper extension 1 or 2:

- You don’t need to re-enrol for the JobKeeper extension if you are already enrolled for JobKeeper for fortnights before 28 September.

- You don’t need to reassess employee eligibility or ask employees to agree to be nominated by you as their eligible employer if you are already claiming for them before 28 September.

- You don’t need to meet any further requirements if you are claiming for an eligible business participant, other than those that applied from the start of JobKeeper relating to

- holding an ABN, and

- declaring assessable income and supplies.

New JobKeeper participants

The JobKeeper scheme will remain open to new participants, provided they meet the eligibility requirements for the relevant period.