Super guarantee increases to 11%

The increase to the superannuation guarantee (SG) rate from 1 July 2023 will see more employees (and certain contractors) entitled to additional SG contributions on their pay. But what happens when income earned before 30 June is paid after 30 June 2023 – will employees be entitled to the higher SG rate of 11%?

SG is based on when an employee is paid

On 1 July 2023, the SG rate increased from 10.5% to 11%. In some cases, an employee’s pay period will cross over between June and July when the rate changes.

However, the percentage employers are required to apply is determined based on when the employee is paid, not when the income is earned. The rate of 11% will need to be applied to all ordinary time earnings (OTE) that are paid on and after 1 July 2023, even if some or all of the pay period it relates to is before 1 July 2023.

This means if the pay period ends on or before 30 June, but the pay date falls on or after 1 July, the 11% SG rate applies on those salary and wages. The date of the salary and wage payment determines the rate of SG payable, regardless of when the work was performed.

Example

Nicholas is an employee of ABC Pty Ltd.

If Nicholas performed work:

• In June (or partly in June and partly in July) but he was paid in July, the SG rate is 11% on his entire payment and contributions, totalling 11% of his OTE for the September 2023 quarter. This must be made to his superannuation fund by 28 October.

• In July, but was paid in advance (before 1 July), the SG rate is 10.5% and contributions totalling 10.5% of his OTE for the June 2023 quarter must be made to his superannuation fund by 28 July.

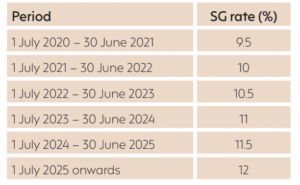

SG rate will continue to rise

Employers should prepare for ongoing, annual increases to the SG rate over the coming years. The following already-legislated increases to 12% by 2025 will proceed as follows:

Basis of SG

SG is only payable on a workers’ OTE. OTE is the amount you pay employees for their ordinary hours of work, including things like commissions and shift loadings, but not in relation to overtime hours (being those outside the ordinary hours stated in a worker’s award or other employment agreement).

More information?

If you are still uncertain around the application of the new SG rate or need guidance on which payments constitute OTE, reach out to us.

Superannuation and the right to delegate

Another key Federal Court case may have a bearing on whether you owe certain workers you engage superannuation guarantee or not.

For background, early last year the High Court made a game-changing decision in determining whether a worker is an employee or contractor at common law. It ruled that this is determined by the employment contract/agreement and whether it contains the usual indicators that tend toward a finding that a worker is an employee at common law including:

■ Does the business have control over the worker (e.g. what hours they work and how they do the work)?

■ Must the worker perform the work personally (rather than having the ability to delegate or subcontract the work to an outside party)?

■ Is the worker paid like an employee (e.g. hourly rate)?

■ Does the business supply the tools and equipment for the worker?

■ Does the business bear the risk and liability to outside parties for any defects in the work?

Where the answer to most of those questions is yes, then the worker is an employee at common law. Up until the High Court’s decision, lower courts were looking at how individual work arrangements were playing out in practice when answering the above questions. The High Court however ruled that you should instead look at the rights and obligations set out in the respective contract between the parties rather than how the situation plays out after the contract is signed. This is provided that the contract was not a sham.

With this new approach in mind, in early June 2023 a case came before the Full Federal Court where it was asked to determine whether a worker was an employee or contractor. Adopting the High Court’s new approach, the Full Federal Court examined the contract and found that the answers to some of the above questions were yes, while the answers to others were no.

However, ultimately it found that because the worker had the ability to delegate/subcontract the work (although a limited ability subject to the approval of the business) the worker was not an employee for superannuation purposes at common law:

.. if a person engaged to perform work has a contractual right to have someone else perform that work, that is a matter which at the very least tends against a conclusion that the person is an employee. The existence of the right is inherently inconsistent with an employee relationship. In the absence of significant countervailing considerations, how can you be an employee if, within the scope of the contract, you can lawfully get someone else to perform the entirety of your contractual obligations, whether for a short period, or for a longer period?

Because the worker had the ability to delegate, he was also not entitled to superannuation under the wider definition of “employee” in the superannuation legislation either which provides that if a person works under a contract that is wholly or principally for the labour of the person, the person is an employee of the other party to the contract. The ability to delegate meant that this test was not met.

The take-home message for employers is that the terms of the written agreement will determine whether a worker is owed superannuation at common law (but that contract cannot be a sham).

However, where the workerhas the ability to delegate, this will generally be decisive – no superannuation will be owed at common law or under the superannuation legislation.

All told, this is a complex area. Reach out to us if you are unsure of whether a superannuation = obligation is owed to a worker.

Time for a restructure?

The new financial year can be a time where business owners look at their operating structure and consider whether it still meets their needs. Choosing a structure is not simply about minimising tax, rather a range of factors should be considered as such as asset protection, establishment and ongoing compliance costs, succession planning, and your understanding of each structure etc.

Most small businesses operate as a sole trader, company, trust, or partnership. The table below is a comparative snapshot of each of the four structures:

You may find that, as your business grows or as your priorities change, your chosen structure no longer serves your needs. For example, a number of people commence businesses as sole traders (often for reasons of simplicity as well as keeping start-up costs to a minimum) but later find that this structure is no longer appropriate. From an income tax perspective, a drawback with sole traders is that income from the business is assessed personally to you at your marginal tax rates. As your business grows and the revenue generated increases, your tax rate also increases.

The take-home message is that you should periodically review your structure to ensure it continues to serve your needs. Be mindful however that changing structures can have CGT and stamp duty consequences – these one-off costs need to be taken into account when making the decision whether to change. Also note that under the small business rollover provisions, it may be possible for you to change your structure without incurring CGT.

Talk to us if you are contemplating changing your business operating structure.

*subject to the Personal Services Income (PSI) rules

Fair Work changes

Although not related to tax, there are a number of changes on the Fair Work front that employers should be aware of.

MINIMUM WAGE INCREASE

The National Minimum Wage applies to employees who aren’t covered by an award or registered agreement. From 1 July 2023, the new National Minimum Wage will be $882.80 per week or $23.23 per hour.

The new National Minimum Wage will apply from the first full pay period starting on or after 1 July 2023. This means if your weekly pay period starts on Monday, the new rates will apply from Monday, 3 July 2023.

Note that if a worker is covered by a registered agreement, the minimum wage increase may apply to them. This is because the base pay rate in a registered agreement can’t be less than the base pay rate in the relevant award. Check your agreement by searching for it on the Commission’s website: Find an agreement

AWARD MINIMUM WAGE INCREASE

The Fair Work Commission has also announced that minimum award wages will increase by 5.75%. Most employees are covered by an award. Awards are legal documents that outline minimum pay rates and conditions of employment in your industry or occupation.

If you’re not sure which award applies to a worker, use Find my award.

This increase will apply from the first full pay period starting on or after 1 July 2023. This means if your weekly pay period starts on Monday, the new rates will apply from Monday, 3 July 2023.

SECURE JOBS, BETTER PAY: 6 JUNE – CHANGES TO WORKPLACE LAWS

From 6 June 2023, changes also came on stream related to:

■ requesting flexible working arrangements

■ extending unpaid parental leave

■ agreement-making

■ bargaining.

For more information, visit, Secure Jobs, Better Pay: Changes to Australian workplace laws.

AGED CARE SECTOR

Direct care and some senior food services employees in the aged care sector will receive a 15% wage increase from 1 July 2023.

For more information, visit, 15% wage increase for aged care sector.

PAID PARENTAL LEAVE SCHEME

From 1 July 2023, the Paid Parental Leave scheme is changing.

From this date the current entitlement to 18 weeks’ paid parental leave pay will be combined with the current Dad and Partner Pay entitlement to two weeks’ pay. This means partnered couples will be able to claim up to 20 weeks’ paid parental leave between them. Parents who are single at the time of their claim can access the full 20 weeks.

These changes affect employees whose baby is born or placed in their care on or after 1 July 2023.

Other changes include:

■ allowing partnered employees to claim a maximum of 20 weeks’ pay between them, with each partner taking at least two weeks (except in some circumstances)

■ introducing a $350,000 family income limit (indexed annually from 1 July 2024) for claiming paid parental leave pay

■ expanding the eligibility rules for fathers or partners to claim paid parental leave pay

■ making the whole payment flexible so that eligible employees can claim it in multiple blocks until the child turns two

■ removing the requirement to return to work to be eligible for the entitlement.

Small business lodgement amnesty

Since Budget night, the ATO has released more information around the small business lodgment amnesty…which can now be taken advantage of from 1 June 2023!

The amnesty was announced in the recent Budget. It applies to tax obligations that were originally due between 1 December 2019 and 28 February 2022 and runs from 1 June 2023 to 31 December 2023.

To be eligible for the amnesty, the small business must be an entity with an aggregated turnover of less than $10 million at the time the original lodgement was due.

During this time, eligible small businesses can lodge their eligible overdue forms and the ATO will then proactively remit any associated failure to lodge (FTL) penalties.

ATO Assistant Commissioner Emma Tobias urged small businesses to take advantage of the amnesty to get back on track with their tax obligations if they have fallen behind.

“The past few years have been tough for many small businesses, with the pandemic and natural disasters having a significant impact. We understand that things like lodging ATO forms may have slipped down the list of priorities. But it is important to get back on track with tax obligations. Lodging these forms are not optional, so we hope our amnesty will make it easier for impacted small businesses to get back on track. When forms are lodged with the ATO under the amnesty, businesses or their tax professionals will not need to separately request a remission of FTL penalties. All you need to do is lodge your outstanding tax returns or activity statements and we’ll take care of the FTL penalty remission from our end. You might see an FTL penalty on your account for a short period of time, but don’t worry, we will remit it.”

Ms Tobias also noted that outstanding lodgements can be an early indicator that a small business is not actively engaged with the tax system, which can be a red flag:

“We encourage all businesses to lodge any overdue forms even if they are outside the eligibility period. Whilst forms outside the amnesty eligibility criteria will attract FTL penalties, the ATO will consider your circumstances and may remit such penalties on a case-by-case basis. We understand that some small businesses may be worried about paying an amount owing on their overdue lodgment. If you are unable to make full payment of your debt, remember we can work together with you or your registered tax or BAS agent to figure out the right solution for you. We want to make this process easy and encourage small businesses to do the right thing. If you have a registered tax or BAS agent, now is a good time to reach out to them to make sure you are up to date with your tax affairs. Taxpayers still have an obligation to lodge overdue forms during the amnesty period and we will continue to work with them to help ensure they meet their obligations,” Ms Tobias said.

The ATO offers a range of support options, including payment plans. Many small businesses are also able to set up their own payment plan online.

Ms Tobias also explained that if a business has ceased trading, they need to advise their registered tax professional, or the ATO directly.

The amnesty applies to income tax returns, business activity statements and fringe benefits tax returns. It does not apply to superannuation obligations and excludes other administrative penalties such as penalties associated with the Taxable Payments Reporting System.

If you are ready to come forward and get your overdue lodgements up to date, we can help you, and hopefully secure the amnesty for you.

Book yourself in for the ‘super health check’ initiative

This tax time, the ATO is introducing the ‘super health check’ initiative. This consists of five simple and important things that individuals can do to get on top of their super, including:

1. Check your contact details.

2. Check your superannuation balance and employer contributions.

3. Check for lost and unclaimed super.

4. Check if you have multiple super accounts and consider consolidating, and

5. Check your nominated beneficiaries.

Individuals are encouraged to complete the check on ATO online services, through myGov or the ATO app at least once a year at tax time. Alternatively, you may wish to contact your superannuation fund to perform this check.

Although the super health check can be done at any time, the ATO is suggesting individuals do it when they prepare their tax return.

This reminder from the ATO is timely given the superannuation guarantee increases to 11% on 1 July 2023.

So make sure you start the new financial year strong and get on top of your super savings.

Work-related car expenses updated

The ATO has just announced that the cents per kilometre rate has increased to 85 cents per kilometre for 2023/24.

To recap, there are two methods to claim work-related car expenses as follows:

1. Cents per kilometre method

This method is easier for record keeping, involves a more simple calculation, and is generally suited to those with less vehicle use.

You simply keep a record of the number of kilometres you’re traveling for work or for business over the duration of the year and you claim these using the set rate.

The drawback of this method is that you are limited to a maximum of 5,000 work-related or business kilometres per year. That gives you a total maximum claim of $4,250. Thus, if you’re using your car a lot for work, you may find that this is method quite limiting.

2. Logbook method

This method can allow for greater claims depending on how much you’re using your car for work or business.

However, there are more recordkeeping requirements – the main one being that you must keep a 12-week logbook that records all of your trips, both business and private, for those 12 weeks.

At the end of the 12 weeks, you calculate your work-related or business percentage use, and you can claim that percentage for all deductions for your car.

You also need to keep all receipts for fuel, insurance, registration, interest, and servicing throughout the year.

As mentioned, despite the additional effort, it can often lead to a greater claim if you are using your car a lot for work and business.

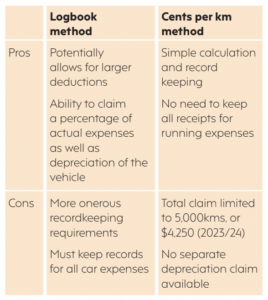

Comparison

Summary

As you can see, both methods have their downsides and can have their benefits too depending on your situation. Consider which is best for you, taking into account:

■ If you have the time or the ability to save all of your car-related records

■ The level of your business-related vehicle use.

Click to view Glance Consultants July 2023 newsletter via PDF