Six super strategies to consider before 30 June

With the end of financial year fast approaching, now is a great time to boost your superannuation savings and potentially save on tax. Below are six superannuation strategies to consider before 30 June 2024.

1. Use the carry forward concessional contribution rules

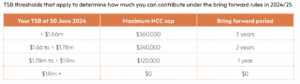

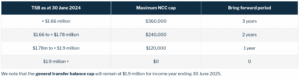

If you want to make up for lost time and make extra contributions to top up your superannuation, you may be able to use the carry forward concessional contribution (CC) rules (otherwise known as “catch-up concessional” rules) to make large CCs this year without exceeding your CC cap.

This strategy can allow you to carry forward any unused CC cap amounts that have accrued since 2018/19 for up to five financial years and use them to make CCs in excess of the general annual CC cap (currently $27,500 in 2023/24).

You can then make a CC using the unused carry forward amounts this financial year provided your total superannuation balance (TSB) at 30 June 2023 was below $500,000.

2. Make a personal deductible contribution

Carry-forward contributions may also provide you with an opportunity to make higher amounts of personal deductible contributions in financial years where you may have a higher level of taxable income, for example, due to assessable capital gains.

But if you’re not eligible to use the carry forward rules to make a larger contribution, you can still boost your superannuation by making a personal deductible contribution up to the general CC cap.

It’s important to note that personal deductible contributions are only deductible if you meet all of the following conditions:

■ You make the contribution to a complying superannuation fund

■ You are at least age 18 when the contribution is made (unless you derived income from carrying on a business or from employment-related activities)

■ You make the contribution within 28 days after the month in which you turn 75

■ You notify your superannuation fund trustee in writing of your intention to claim the deduction

■ The notice must be given by the earlier of:

• when you lodge your income tax return for the year the contributions were made, or

• the end of the financial year following the year the contributions were made

■ The trustee of your superannuation fund must acknowledge receipt of the notice, and you cannot deduct more than the amount stated in the notice.

3. Spouse contribution splitting

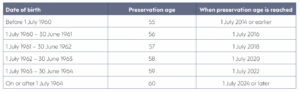

You can split up to 85% of your 2022/23 CCs before 30 June 2024 to your spouse’s superannuation if your spouse is:

■ Under preservation age (currently age 60 if born on 1 July 1964 or later), or

■ Aged between their preservation age and 65 years, and not retired at the time of the split request.

This is an effective way of building superannuation for your spouse and can manage your TSB which can have several advantages, such as:

■ Equalising your balances to maximise the amount you both have invested in tax-free retirement phase income streams, or

■ Optimising both of your TSBs to access a higher NCC cap,º etc.

4. Superannuation spouse tax offset

If your spouse is not working or earns a low income, you may want to consider making a NCC into their superannuation account. This strategy could benefit you both by boosting your spouse’s superannuation account and allowing you to qualify for a tax offset of up to $540.

You may be able to get the full offset if you contribute $3,000 and your spouse earns $37,000 or less pa (including their assessable income, reportable fringe benefits and reportable employer superannuation contributions).

A lower tax offset may be available if you contribute less than $3,000, or your spouse earns between $37,000 and $40,000 pa.

5. Maximise non-concessional contributions

Another way to boost your superannuation is to make a NCC with some of your after-tax income or savings. The general NCC cap for 2023/24 is $110,000 and eligibility to utilise the cap depends on your TSB.º

Although NCCs don’t reduce your taxable income for the year, you can still benefit from the low tax rate of up to 15% that is paid on superannuation on investment earnings. This tax rate may be lower than what you might pay if you held the money in other investments outside superannuation.

6 Receive the government co-contribution

If you’re a low or middle-income earner earning less than $58,445 in 2023/24 and at least 10% is from your job or a business, you may want to consider making a NCC to superannuation before 1 July 2024. If you do, the Government may make a ‘co contribution’ of up to $500 into your superannuation account.

The maximum co-contribution is available if you contribute $1,000 and earn $43,445 pa or less. You may receive a lower amount if you contribute less than $1,000 and/or earn between $43,445 and $58,445 pa.

Like the superannuation spouse tax offset, the definition of total income for the purposes of the co-contribution includes assessable income, reportable fringe benefits and reportable employer superannuation contributions.

You’ll need to meet certain eligibility conditions before benefitting from any of these strategies. Contact us before 30 June if you’re thinking about investing more in superannuation so we can help you decide which strategies are most appropriate to your circumstances.

º: Refer to Super contribution caps to increase on 1 July in last month’s Newsletter (March 2024) for more information.

Important tax residency issues to consider

What happens from a tax point of view when a person leaves Australia part- way through the income year? How is the income they derived before that time taxed? And how is any income they derived after that time taxed (whether from Australian or foreign sources)?

Well, the answer will primarily depend on whether the person ceases to be a “resident of Australia” for tax purposes at the time they leave Australia.

This can be one of the most difficult issues in tax law to determine. Not only will it depend on the precise facts and the intention of the taxpayer, but it can also involve what often seems to be a “judgement-call” at the relevant time. This is especially the case as a taxpayer’s residency status is worked out on an income year basis, and this can change from one income year to another.

But putting aside all the issues involved in determining whether a person ceases to be a resident of Australia for tax purposes part-way through an income year, let us assume this is the case.

So, what are some of the general tax consequences associated with such part-year residency?

For a start, the person’s tax threshold for the relevant income year will be adjusted downwards (pro-rated) to reflect the fact that the person ceased to be a resident for tax purposes part-way through the income year. As a result, this pro-rated threshold will apply to the person’s assessable income:

■ from all sources both within and outside Australia for the period they are a resident of Australia, and

■ from sources within Australia while they are a foreign resident.

Importantly, this in effect means that the resident tax rates do not change on the basis of a person’s part-year residency – but only the relevant tax-free threshold.

It should also be noted that assessable income derived from sources outside Australia during the period in the income year that the person is a “foreign resident” will not be subject to tax in Australia as it will be outside the Australian taxing jurisdiction.

And, of course, for the following income years the person will be assessed as a foreign resident and therefore only pay tax in Australia on Australian-sourced assessable income at foreign resident rates.

Another consequence that is often overlooked is that a person ceasing to be a resident of Australia for tax purposes will be deemed to have disposed of all their Australian-sourced CGT assets for their market value at that time. However, this is subject to an exception for “taxable Australian property” (which always remain subject to CGT regardless of the taxpayer’s residency status) and any “pre-CGT” assets of the taxpayer.

Furthermore, a person can instead choose to opt out of this “deemed disposal” rule – in which case all their Australian-sourced CGT assets will be treated as taxable Australian property until they are actually disposed of or the taxpayer becomes a resident of Australia again for tax purposes.

So, these are some of the tax considerations to be taken into account on a person ceasing to be a resident of Australia. But the key question of determining a person’s residency for tax purposes remains – and this is not always an easy issue.

For example, in a recent tax decision, the Administrative Appeals Tribunal held that a person was a resident of Australia for tax purposes even though they were working outside the country for substantially more than half the year and even though this occurred over a four-year period.

The AAT found that because the taxpayer’s wife and family remained in Australia and because he had other connections to Australia such as the ownership of property and motor vehicles here, then he was a resident for tax purposes – as he had no “plans to abandon Australia”.

The case illustrates something of the difficulty of determining a person’s residency for tax purposes. It is clearly a “case-by-case” matter.

And it is clearly something on which professional advice should always be sought.

Family companies and the many tax traps

If you own a family company, then it is very important how you receive and treat any payments made from the company to you (or your associates – for example, your spouse). And this is simply because any payment from a company (other than a return of the original capital) is, in most cases, prima-facie a dividend in the hands of the recipient – however it may otherwise be classified.

In particular, if you arrange for your company to provide you (or your associate) a loan, then it will be deemed to be a taxable dividend (and an unfranked one at that) – unless you comply with the requirements for it to be a “complying loan’’ (which includes imposing a market rate of interest on it).

Likewise, any forgiveness by the company of the loan made to you will be treated as a deemed dividend in your hands also – again unless certain requirements are met.

This area of treating loans by the company to a shareholder (or associate) as a deemed “Div 7A dividend” is a fundamental issue in tax law – and has been for many, many years.

And it is a matter that you should always speak to your adviser about.

Importantly, it also extends to the case where your family trust makes a resolution to distribute trust income to a beneficiary company (usually a so-called “bucket company”) and the amount is never actually paid to the company but is kept in the trust.

In this case, the ATO treats this as a deemed dividend made by the company to the trust – albeit, it is a hot button issue in tax at the moment as to whether the ATO is correct in its approach to this.

Again, this is a matter that you MUST always speak to your adviser about – especially with the current uncertainty and changes in the air in relation to Div 7A.

With family companies there is also the issue of loans made by shareholders or directors to the company and any subsequent forgiveness of them.

On the face of it a complete forgiveness of the debt owed without any repayment of the loan should trigger a capital loss in the hands of the shareholder or director.

However, the tax laws are more sophisticated than this – and a capital loss will only arise to the extent that the debt is incapable of being repaid by the company. There is also an argument as to whether any capital loss should be available at all even if the company could not repay the debt.

Likewise, there will be consequences for the company.

While no immediate taxable gain will arise to the company from the release of its obligation to repay the debt, there may be a restriction on its ability to claim tax deductions in the future for such things as carry forward tax losses and/or depreciation.

While this may not be an issue if the company is winding up, it will be if it continues to operate.

So, the moral of the story is just because you own the company doesn’t mean you can treat it as your own private bank to make withdrawals from it as you please or make loans to it (and forgive them) – without considering the serious tax consequences of such actions.

There will always be tax consequences – and you will always need professional advice on this matter.

Selling your home to a developer? Beware the tax consequences!

The NSW state Government is attempting to help with the housing affordability crisis by making areas around train stations and shopping centres eligible for rezoning for denser development. It will be important to see your tax adviser if you receive a generous offer from a property developer for your home (or rental property) as a result of this rezoning. And not just if you live in NSW.

This is because you will have to consider the capital gains tax (CGT) – or possible other income tax consequences – of selling your home or rental property in these circumstances – including where you may be forced to sell under some state compulsory acquisition rule (eg, in relation to strata units).

In relation to something that is your home you should be right as a home is exempt from CGT.

But if you have ever used your home to produce assessable income (eg, rented the whole or a part of it out or used it as a place of business) you will be subject to a partial CGT liability – and calculating the amount of this liability can be quite complex, depending on the exact situation.

For example, if you originally lived in the home and rented it for a period you will ordinarily be able to apply the “absence concession” to continue to treat it as your home and therefore sell it CGT-free.

But if you can’t, you will have to reset its cost for CGT purposes by reference to its market value at the time you first rented it and then recalculate its precise cost for the calculation of the partial gain. This includes knowing what range of expenses can be included in this cost!

Likewise, if you use part of your home as a place of business you will have to reset its cost for CGT purposes on the same basis – but in this case you may (and it’s a big “may”) be entitled to the CGT concessions for carrying on a small business.

But this is an area ripe with confusion – and controversy (unbeknown to many).

And then of course, there is the issue of whether you qualify for the generous 50% CGT discount to reduce any assessable capital gain – and this is often not as simple as it looks.

It may even be the case that you could be assessed on any gain you make on the sale of your property on the basis that it is like taxable business income (and not a concessionally taxed capital gain). And this can potentially happen if you carry out activities in a business-like manner to increase the value of your home in order to fetch a higher price from developers. There is even recent case law on this matter which confirms this view (albeit, this case law is only at a lower tribunal level).

So, if for better or worse, if you find yourself being approached by a developer to sell your home (or other real estate), go see your tax practitioner. Their advice will be invaluable in perhaps this one-off chance to make a significant gain on your main asset.

The tax treatment of compensation payments can be tricky

If you have had a rental or commercial property damaged by recent summer storms (or bushfires or floods) you may have received an insurance payout to cover the damage. You may be surprised to know that this payout is subject to capital gains tax (CGT) on the basis that it arises from your right to seek compensation (being a CGT asset itself). However, the tax law and the ATO will treat it concessionally depending on what exactly the payout is for and how it will be used.

For example, if the payout is for the “destruction or loss” of the whole or part of the property, the payout won’t be subject to CGT at that time – but only if it is used to acquire a replacement asset within the required time (generally two years). This is because a “concessional roll-over” applies in the circumstances.

However, there may be an immediate CGT liability (and/or other CGT consequences) if only some (or more) than the amount of the payout is used in acquiring a replacement asset.

On the other hand, if a payout is received for merely some “permanent damage” to the property then a different CGT concession will apply – namely, there will be a reduction in the cost base of the property for CGT purposes by the extent of the compensation received (and whether or not the proceeds are used to repair or restore the damaged property).

So, if you find yourself in this situation, it is vital to see your tax professional to help assess what situation you fall into – and furthermore how the compensation is exactly treated in that case.

In the different case where you receive compensation for wrongful dismissal from work and/or for injury suffered at work, it is also vital to seek professional advice. This is because such compensation can potentially be treated in one of several ways:

■ Firstly, it may be treated as assessable income to the extent it is a substitution for lost income – regardless of whether it is received in a lump sum form or not and however it is calculated.

■ Secondly, it can be treated as being exempt from being assessable income (and CGT) where it is received for injury, the loss of physical capacity, illness, pain, suffering or where it is paid under anti-discrimination legislation.

However, determining which category of compensation such a payment falls into is not always easy – especially where it may be an out- of-court settlement payment which comprises both types of payments. While generally such payments will not be taxable, if they are an out-of-court settlement and the whole or part of the payment can be identified as comprising compensation for lost income (by whatever means, such as the initial pleadings), then that component can be assessable.

So, suffice to say your professional adviser is invaluable in this situation – and in particular before agreeing on the receipt of any such settlement payment.

Mortgage vs super: Where should I put my extra cash?

Many of us wonder about the best vehicle to use for our extra savings. Is it better to direct extra savings to your mortgage or superannuation? As with most financial decisions, there is no one-size-fits-all approach as it depends on a number of factors for each individual.

Paying extra off the mortgage

The priority for most people is to pay extra off their mortgage. This is because extra repayments can reduce the amount of interest payable and will help you pay off your loan sooner, freeing you up from mortgage repayment commitments.

Furthermore, if your home loan has a redraw or offset facility, you can still access your money if your circumstances change.

However paying extra off your mortgage involves using after-tax money which is less advantageous than using pre-tax income to invest into superannuation which will eventually be used to pay off your mortgage.

Paying extra into superannuation

Paying extra to superannuation will usually involve pre-tax money by making salary sacrifice contributions. An effective salary sacrifice agreement involves an employee agreeing in writing to forgo part of their future entitlement to salary or wages in return for the employer providing them with benefits of a similar value, such as increased employer superannuation contributions.

As salary sacrifice contributions are made with pre-tax dollars and do not form part of your assessable income, this means these contributions are not taxed at your marginal tax rate and will instead be taxed at a maximum of 15% when received by your superannuation fund.

It is also worth noting that making pre-tax contributions such as salary sacrifice contributions count towards the concessional contribution (CC) cap which is currently $27,500 pa in 2023/24 (or $30,000 in 2024/25). As your employer superannuation guarantee (SG) contributions also count towards this cap, you will need to determine how much room you have left within your cap before you start salary sacrificing to superannuation. As discussed in Six super strategies to consider before 30 June on page 1, there is the ability to make larger CCs by utilising the carry forward concessional contribution rules if you meet certain eligibility criteria.

In a nutshell, once the money is in superannuation it is invested and will grow. The power of compounding returns along with the concessional tax nature of superannuation means that even small contributions can boost your retirement savings in the future. When the time is right and you are ready to retire, you can either withdraw a tax-free lump sum to clear your remaining mortgage or commence a superannuation pension and draw tax-free pension payments to meet your mortgage repayments from the age of 60 onwards.

Example – pre vs post tax money

Bill earns $150,000 per year and has a savings capacity of around $1,000 – $1,500 per month. Bill can either:

• Direct this amount to his mortgage, or

• Salary sacrifice $1,587 into superannuation as this contribution occurs before tax (ie, the after-tax cost of $1,587 is $1,000).

Bill decides to salary sacrifice to superannuation. Bill’s contribution is taxed at 15% when it is received by his fund so his end contribution is $1,349. For the same out-of-pocket cost to Bill, his superannuation fund receives an extra $349 each month.

This example shows the difference between Bill’s marginal tax rate (37%) and the tax rate on contributions (15%) constitutes the benefit of salary sacrifice contributions. As mentioned above, Bill will need to ensure he does not exceed his CC cap by making extra salary sacrifice contributions to superannuation.

Final thoughts

So which option is better? Well it depends. The answer boils down to a number of factors that need to be considered, such as your mortgage interest rate, your income and marginal tax rate, your superannuation investment strategy, and your age to retirement. If you need extra information or advice on what you should do, make sure you speak to your financial adviser before you make any financial decisions regarding your mortgage or superannuation.

Click to view Glance Consultants April 2024 Newsletter via PDF