On the road – How to treat work-related travel and living away from home costs.

The ATO has released new guidance to help clarify the tax treatment of costs and allowances incurred when an employee travels – or spends time living away from home – for work.

Certain conditions need to be met to ensure an allowance can be considered a travel allowance:

■ None of the individual absences from the employee’s usual place of residence exceed 21 days.

■ The employee is not present in the same work location for 90 or more days in an FBT year.

■ The employee returns to their usual residence once their period away ends.

See the table on the following page for a breakdown of the characteristics of travel allowances versus living away from home allowances.

Where the applicable allowance type remains unclear, certain questions can be asked to discern further, such as:

■ Has there been a change in the employee’s regular place of work?

■ Is the duration of the employee’s period away from home relatively long?

■ Is the nature of the accommodation such that it becomes the employee’s usual place of residence?

■ Can the employee be visited by family and friends?

Of course, for a travel expense to be deductible, the employee must be able to demonstrate that it was incurred while travelling for work. Unless exceptions apply, the employee must maintain written evidence of the expenditures and keep travel records for work- related trips that involve an absence of six or more consecutive nights from their usual residence.

The ATO does allow for the not-uncommon scenario where an employee attending a conference, for example, is accompanied by their spouse and stays an extra few days for leisure purposes – although reasonable apportionment is required in these cases.

The ATO also recognises that where employees regularly travel to the same location they may choose to rent or even buy a property there rather than stay in a hotel, motel or AirBnB. The associated costs will be deductible provided they are not disproportionate to what would have been paid had the employee elected to use suitable commercial accommodation instead.

It’s important that allowances paid (or reimbursements made) to cover an employee’s accommodation, food and drink expenses do not form part of a salary packaging arrangement, and must be included in the employee’s payment summary with tax withheld where appropriate. The employer should also obtain and retain documentation establishing that all the circumstances have been met.

SMSFs & property development Emerging risks

There has been an increase in the number of SMSFs entering into arrangements where real property is purchased and developed to subsequently be sold or rented out. Such investments can help the fund build up its wealth more quickly than other forms, and from a tax standpoint, any rent or eventual capital gain may enjoy concessional tax treatment.

There are four main ways an SMSF may structure a property development investment or arrangement:

■ Engage an unrelated property developer. The simplest and least risky method, where a developer undertakes the development for payment.

■ Undertake the development itself. For example, an SMSF purchases a house and does its own renovations. The key issues to avoid here are payments to related parties and borrowing funds to finance improvements.

■ Invest in an ungeared related unit trust or company. In this scenario, the trust/company would undertake the development. Such an entity is not subject to the in-house asset rules (unlike a related geared unit trust), but must meet the requirements listed in the Superannuation Industry (Supervision) Regulations 1994 (SIS Act).

■ Through unrelated unit trusts. Where no single SMSF owns 50% or more of the units in a unit trust (as doing so would mean it was in control of the trust and thus a related trust). This has the advantage of allowing the unrelated unit trust to borrow.

SMSF property development is layered with complexity. The sole purpose test, payments to related parties, and the in-house rules are just some of the SIS Act provisions that can lead to an SMSF becoming non- compliant. While the ATO recognises that property development can be a legitimate option for SMSFs, it has flagged the following investment types as liable to raise a red flag:

■ Where they are used to inappropriately divert income into the superannuation environment.

■ Where property development ventures are funded in a way that is inappropriate for retirement purposes.

■ Where they are implemented in a way that can lead to inadvertent but serious contraventions of the SIS Act.

What are some of these potential contraventions?

■ Collateral purposes. Where a property development venture could amount to the SMSF being maintained for a collateral purpose – that is, one other than providing retirement benefits to its members (or their dependants). For example, where the SMSF trustees have other roles within the property development venture (either through other businesses or control of other entities), it is important they can demonstrate that decisions made were solely pursuing the retirement purpose of the SMSF.

■ Related party loans/financial assistance. SMSFs are prohibited from providing loans or financial assistance to members or their relatives. In the property development space, this means not engaging a related party to provide services as a means of providing them with work, and not paying more than market value for their services.

■ Operating standards. SMSF money and assets must be kept separate from those held by a trustee personally; assets must be appropriately recorded at market value; and all transactions carefully documented.

■ Limited recourse borrowing arrangement. An SMSF may borrow money to acquire the land/ property by entering into a LRBA, but the LRBA must be on arm’s-length terms – that is, trustees should consider: repayments and ability to repay; arrangements to provide security to a lender; and related party fees. Also, the amounts borrowed cannot be used to develop or improve the acquirable asset, and if money from other sources is used to fundamentally change the property’s character, it may contravene LRBA requirements by ceasing to be the same/original single acquirable asset.

■ In-house assets. Subject to certain exceptions, an in-house asset of a superannuation fund is an asset that is: a loan to a related party of the fund; an investment in a related party of the fund; an investment in a related trust of the fund; or an asset of the fund that is subject to a lease or lease arrangement between the trustee of the fund and a related party of the fund. Contraventions of the in-house asset rules can occur where the SMSF is deemed to be “investing” in the property development, and thereby potentially exceeding the level of in-house assets allowed (i.e. more than 5% of the market value of the fund’s assets in any financial year).

■ Taxation. SMSFs in the property development game also need to properly discharge their tax obligations, which include income tax matters (such as the non- arm’s length income provisions and general anti- avoidance rules) as well as GST matters (such as registration requirements, correct reporting and the application of the margin scheme).

The ATO is closely monitoring property development arrangements involving SMSFs, and while SMSFs investing in property development will often deal with related parties as part of that development, it’s imperative for trustees to recognise that each transaction must be conducted on arm’s-length terms and recorded as such.

SMSF clients should seek independent advice before entering into property development arrangements, as non-compliance can result in adverse consequences including the forced sale of assets and even closure of the SMSF.

Clients who have already developed property or invested in a property development venture should assess their investment against the issues flagged here – and where contraventions or concerns are identified, disclose them to the ATO so that rectification plans can be put in place.

Claiming GST credits for employee reimbursements

If you are an employer registered for goods and services tax (GST), you may be entitled to claim GST credits for payments you make to reimburse employees (including company directors) or partners in a partnership for certain work-related expenses.

If you are running a business, you will be entitled to a GST credit for an employee-reimbursed expense if the following criteria are met:

■ the employee’s (or associate’s) expense is directly related to their activities as your employee or the reimbursement is an “expense payment benefit”

■ the sale of the item bought by your employee was taxable (that is, not “input taxed”), and

■ your employee is not directly entitled to a GST credit for the expense.

The ATO says a business can claim GST credits where it has relevant documents such as receipts or tax invoices issued to the employee. These will need to be provided to substantiate claims for reimbursement.

A business that is entitled to a GST credit can claim it in a Business Activity Statement once it has been provided with this documentation.

An “expense payment benefit” is made, according to the ATO, when a business makes a payment to, or reimburses, another person “in whole or in part, of an amount of money spent by your employee as part of their employment with you”. Fringe benefits tax (FBT) may apply however.

A business is not entitled to a GST credit if it has:

■ reimbursed “non-deductible expenses”, such as the portion of expenses relating to entertaining clients (usually only half of such expenses are deductible for the provision of entertainment)

■ reimbursed expenses that relate to input taxed sales that are made in the running of the business and it exceeds the special threshold for financial purchases (a reduced GST credit is therefore available on specific purchases), or

■ paid the employee an “allowance”.

The ATO says that if a business makes a payment to an employee based on a “notional” rather than an actual expense, it is not making a reimbursement. For example, if a business makes a cents-per-kilometre payment to cover work-related use of an employee’s private car, it is paying an allowance and not making a reimbursement (again, consider the FBT implications).

MAKING REIMBURSEMENTS

A business makes a reimbursement where it pays an employee for the price, or part of the price, of a particular purchase they made.

For example, if an employee incurs an expense of $220 for a purchase, and is re-paid the whole $220 or even half of that, either payment will be a reimbursement. A business will also have made a reimbursement if:

■ it pays the employee for a particular expense they haven’t paid, provided they have become liable for the expense

■ it pays the employee an advance for an expense they have not yet incurred, providing they have to repay any unspent amount of the advance to the business, or

■ it pays an expense on behalf of the employee, for example, to the business that has made a sale to the employee (the GST legislation treats this type of payment as a reimbursement).

Where any personal use of a purchased item is involved, or the expense relates to non-cash employee benefits, liability for FBT should be a consideration.

Buying a new home before selling the old one: The ins and outs

Sometimes an individual or couple decide to buy a new home before selling their existing one. In such cases, a concession exists that allows for both houses to be treated as a main residence for up to six months – but only if certain conditions are met. Section 118-140 of the Income Tax Assessment Act 1997 (ITAA 1997) provides that both the old and new dwellings can be treated as the taxpayer’s main residence for the lesser of:

■ The six-month period immediately before the sale of the existing home, or

■ The period between the purchase of the new home and the sale of the existing home.

So if it takes a taxpayer less than six months to settle on the sale of their original home after having settled on the sale of their new home, then both homes can be treated as the taxpayer’s main residence during this period.

On the other hand, if more than six months passes between the settlement of the new home and the (later) settlement of the original home, both dwellings will only be treated as a main residence for a maximum period of six months before the settlement on the original home.

In the latter instance, a partial CGT exemption will apply during the excess period (i.e. after the maximum six months) to either the original or new home. Which of them it is will depend on which did not qualify as the taxpayer’s main residence.

Other than the fundamental requirement that the new home must become the taxpayer’s main residence, the other two key requirements that must be met for the concession to apply are:

■ The existing home must have been the taxpayer’s main residence for at least 3 of the 12 months before the taxpayer’s “ownership interest” in it ends, and

■ The existing home must not have been used to produce assessable income in any part of that 12-month period when it was not the taxpayer’s main residence.

That said, an absence concession exists that can be used to allow the original home to qualify as a main residence — including where it may have been rented in that 12-month period. This is because the effect of the absence concession is to continue to “treat” the original home as the taxpayer’s main residence — notwithstanding any absence and any income use in this period.

The example on the following page featuring ‘Anne’ illustrates how the “absence concession” can work in conjunction with the “changing main residence concession”.

Note that that purchased vacant land or land with a partly constructed building on it can also be treated as the taxpayer’s new home for the purposes of the concession.

Example scenario

Anne acquired a dwelling on 1 January 2008 where she lived until she went overseas on 1 January 2019. Anne did not rent the home during her absence. She acquired another dwelling on 1 February 2020 and moved into that dwelling on her return from overseas on 1 March 2020. Anne disposed of the first dwelling on 1 August 2020.

The law recognises that Anne continued to treat the first dwelling as her main residence for the period 1 January 2019 until she disposed of it on 1 August 2020.

In fact, from 1 February 2020 Anne would have been able to treat both dwellings as her main residence for up to six months, ending when she ceased to have an ownership interest in the first dwelling.

Trust distributions to non‐residents

When an Australian trust makes a distribution to a non-resident beneficiary, it is often the case that the Australian trust is required to pay tax on the distribution.

The trustee’s payment of tax on trust distributions to non-resident beneficiaries of an Australian trust is a tax collection security measure. It is a type of withholding tax, which is not a final tax in Australia.

When the non-resident beneficiary lodges their Australian tax return, the beneficiary will be refunded some of the tax paid by the Australian trust if the tax paid by the Australian trust exceeds the amount payable by the non- resident beneficiary.

Where an Australian trust makes a distribution to a non-resident trust that, in turn, distributes the amount to a non-resident individual, the non-resident trust is not liable for Australian tax.

Where the Australian trust derives dividends, interest or royalties – and distributes this income to a non- resident beneficiary – the Australian tax law applies a withholding tax to the payments. The rate of withholding depends on the type of income and whether Australia has a double tax agreement with the country to which the amount is being paid.

The payment of the withholding tax by the trustee is a final Australian tax – which means the non-resident beneficiary is not subject to any further Australian tax on the income.

Generally, where an Australian fixed trust makes a capital gain from the disposal of assets that are not directly or indirectly related to real property located in Australia and distributes that gain to a non-resident beneficiary, neither the Australian trust nor the non- resident beneficiary are liable to Australian tax.

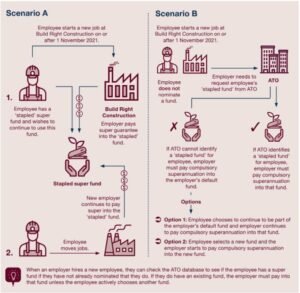

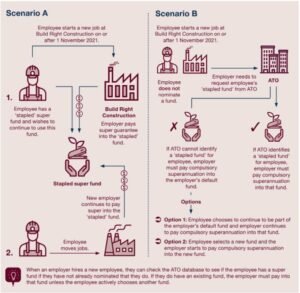

Stapling super: Reducing multiple accounts for employees

New legislation will ensure that when an employee moves jobs, the super fund they used with their former employer will be ‘stapled’ and will automatically follow them.

Under current rules, if an employee changes jobs multiple times over their working life and does not nominate a superannuation fund to their employer, they could end up with multiple superannuation accounts, each charging their own fees and insurance premiums.

To prevent this from happening and to stop unintended accounts being created for employees, including for short-term jobs, the Your Future, Your Super legislation will require that a person’s super is ‘stapled’ to them (unless they actively choose to change funds) as they progress their employment.

The changes will apply to employees starting a new job from 1 November 2021.

Click here to view our Glance Consultants Newsletter via PDF