Temporary Full Expensing: get in quick!

This could be the final opportunity for your business to take advantage of Temporary Full Expensing (TFE)…but get in before 1 July!

To recap, TFE encourages and supports businesses by allowing an immediate deduction for the business portion of the cost of a depreciating asset. There is no cost threshold – the whole cost of the asset can be written off in the relevant year. However, cars can only be depreciated up to the car limit which is currently $64,741. The car limit does not, however, apply to vehicles fitted out for use by people with a disability.

For background, a ‘car’ is defined as a motor vehicle designed to carry a load of less than one tonne and fewer than nine passengers (excluding motor cycles and similar). Therefore, for those vehicles, the car limit has no application, and full depreciation is available.

Benefits

The principal benefit of TFE is cashflow. TFE enables businesses to bring forward their depreciation claims, and therefore their deductions upfront, into a single year rather than having them spread out over multiple future years. Ultimately, this assists cashflow which itself is one of the main challenges faced by businesses.

Eligibility

The vast majority of businesses including sole traders will be eligible for TFE as their aggregated, annual turnover will be less than $5 billion. Until 30 June 2023, under TFE, businesses can claim both new and second-hand depreciating assets where those assets are used or installed ready for use for a taxable purpose. From a timing standpoint, this means you will not be eligible for TFE in this financial year if you merely order or pay for an eligible asset before 1 July, 2023 – rather, the asset must be used or installed ready for use in your business before this date.

Ineligible assets

Most business assets are eligible including machinery, tools, furniture, business equipment etc.

There are however some ineligible assets as follows:

■ buildings and other capital works for which a deduction can be claimed under the capital works provisions in division 43 of the Income Tax Assessment Act 1997

■ trading stock

■ CGT assets

■ assets not used or located in Australia

■ where a balancing adjustment event occurs to the asset in the year of purchase (e.g. the asset is sold, lost or destroyed)

■ assets not used for the principal purpose of carrying on a business

■ assets that sit within a low-value pool or software development pool, and

■ certain primary production assets under the primary production depreciation rules (including facilities used to conserve or convey water, fencing assets, fodder storage assets, and horticultural plants (including grapevines)).

Business plan

Because under TFE you cannot claim any extra depreciation deductions than under the standard depreciation rules, you should stick to your business plan and only continue to buy assets that align with that plan and that you were contemplating buying anyway…and then enjoy the cashflow benefits of TFE.

If you have any questions about TFE – especially around asset eligibility and timing leading up to 30 June – reach out to us.

How to claim an early tax deduction on SG contributions

Are you an employer who needs to make superannuation guarantee (SG) contributions for your employees? If so, it may be worthwhile bringing forward these SG contributions to before 1 July to benefit from a tax deduction this financial year. However the timing of when SG contributions are deductible to an employer can be tricky if employers pay SG contributions for their employees via a superannuation clearing house (SCH).

RECAP – WHAT IS A SCH?

The ATO’s free Small Business Superannuation Clearing House (SBSCH) is the only ‘approved’ clearing house – none of the many commercial clearing houses have this status. The SBSCH is a free service that small businesses with 19 or fewer employees, or an annual aggregated turnover of less than $10 million, may use to make superannuation contributions to employees.

The SBSCH aims to reduce compliance costs for small business employers by simplifying and streamlining the process of making employee superannuation contributions, by allowing employers to make a single lump payment of their contributions to the SBSCH each quarter. That lump sum payment is broken into individual payments by the SBSCH, and then contributed to each employee’s respective super fund or RSA.

TAX DEDUCTION AVAILABLE FOR EMPLOYERS

Employers can claim income tax deductions for SG contributions made to a superannuation fund on behalf of their employees, subject to certain conditions being met.

As the income tax deduction is available in the financial year the contribution is made, some employers may wish to improve their current year tax position by bringing forward the June quarter SG contributions to before 1 July, even though these SG contributions are not due until 28 July 2023.

TAKE CARE IF YOU USE A SCH

As mentioned above, SG contributions are tax deductible in the year in which they are made. That said, a contribution is not made until it is received by the fund, and when that happens depends on the way in which the contribution is made.

This is clear cut where an employer pays SG contributions directly to an employee’s nominated superannuation fund. That is, the contribution will be made when it is received by the fund.

However, the timing of the tax deduction and when the contribution counts towards the employee’s contribution cap is not as straightforward where SG contributions are made to a SCH for all employees. Here, the SCH electronically transfers SG contributions to employees’ funds on the employer’s behalf.

In this situation, the contribution is not made at the time the clearing house is credited with the funds from the employer.

Rather, the contribution is made and therefore deductible when the funds are credited to the respective employee’s superannuation fund (following an electronic transfer of money from the clearing house) and then allocated to the employee’s superannuation account.

Tip: Employer SG obligations – For SG purposes, an employer who makes contributions via the SBSCH is treated as having satisfied its SG obligations when the monies are received by the clearing house.

BEWARE OF TIMING DELAYS

The ATO is aware that there may be a period of time between an employer’s payment to the SBSCH and superannuation fund receiving the contribution. Further, the SBSCH may be unavailable over a weekend close to the end of the financial year for scheduled system maintenance.

This means that payments made towards the end of a financial year may not be received by an employee’s superannuation fund in the same financial year. This may therefore impact when an employer is entitled to an income tax deduction for the SG contributions.

ACTION ITEMS FOR EMPLOYERS

For those employers who do not use the SBSCH but instead use commercial clearing houses, for the contributions to be deductible in 2022/23, it is recommended that it be made up to 21 days before the end of the financial year.

For employers who make contributions directly to their employees’ superannuation funds, the contributions should be made a few days before the end of the financial year to ensure they are received before 1 July and therefore deductible in the current financial year.

Federal Budget -what to watch out for

It’s now only a week or so until the Federal Budget, which is to be handed down on 9 May.

Some of the things to look out this year potentially include:

Abolition of Temporary Full Expensing

Under current legislative settings, TFE (see earlier) is set to cease on 1 July 2023 with the write-off set to revert to just $1,000 from that date. If no action is taken in the Budget to extend TFE, this will have a cashflow impact on businesses in the sense that depreciation deductions will be spread out over a number of years rather than being claimed upfront. Record keeping will also be more burdensome in this space.

Stage three tax cuts

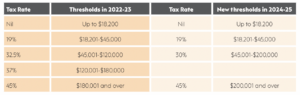

The fate of these tax cuts is also expected to be revealed. This round of tax cuts follows the first two stages which are now law, and which largely benefited lower income earners. If the stage three tax cuts are to proceed, from 1 July 2024, they will abolish the current 37% tax bracket, lower the existing 32.5% bracket to 30%, and raise the threshold for the top tax bracket from $180,001 to $200,001. The following table illustrates how the rates and thresholds will change if the tax cuts proceed (see below).

On the face of it, lowering the 32.5% tax bracket to 30% and removing the 37% tax bracket altogether seems like a big win for middle and upper-middle income earners. But it will actually be a much bigger win for higher-income earners, in dollar terms.

For example, an individual who earns:

■ $75,000 will be better off by $750 per year compared to now

■ $125,000 will be better of by $2,225

■ $200,000 will be better off by $9,075.

Low and middle income tax offset (LMITO) replacement?

This $1,500 tax offset ceased from 1 July 2022. The LMITO was introduced by the former Coalition government in 2018. It was only meant to be paid out once but was twice extended due to the COVID-19 pandemic. We will wait until Budget night to see what, if any, alternative tax relief is offered to low and middle income earners, or indeed whether the LMITO is reinstated. If not, then low-income earners may face an increased tax liability of up to $1,500 when upcoming 2022/23 tax returns are lodged.

CGT concessions trimmed?

While it’s unlikely the CGT main residence concession on the family home will be reduced, the 50% CGT discount for other investments held more than a year could be partially on the chopping block for some people. It’s possible to imagine a reduction in the discount for capital gains over a certain threshold – say $3 million, in line with the threshold for the recent increase to superannuation earnings – limiting the impacts to a smaller, wealthier cohort of individuals.

MORE INFORMATION

In the days following, please contact us if you have any questions around how the Budget may impact your business, investments, or you as an individual.

Financing motor vehicles

One of the most common decisions facing business is how to finance and account for the acquisition of a motor vehicle. There are numerous ways of doing so, with each resulting in differing accounting, taxation and GST treatment.

OPTIONS

How should you go about purchasing a vehicle? While it may seem a relatively straightforward question, there are numerous ways of doing so. Some of the more common methods are:

■ Outright purchase

■ Lease

■ Hire purchase, or

■ Chattel mortgage.

Outright purchase

The advantage of purchasing a vehicle outright, as opposed to financing the acquisition of the vehicle, is that there will be no ongoing costs of finance. This is a real benefit now that interest rates are on the rise.

On the downside, the outright purchase of a vehicle can impact greatly on the cash resources of an entity when those funds may be better utilised elsewhere.

It is far easier to obtain finance for the acquisition of a vehicle than it is for the acquisition of trading stock. Care should therefore be taken not to cripple your business’s cashflow if considering an outright purchase.

Lease

Rather than choosing to acquire a vehicle outright, your business may elect to finance the acquisition. The central issue that surrounds any form of financing, and how it is to be accounted for, is whether the person providing the asset under the finance arrangement is the legal owner of that asset. This issue goes to the heart of how the finance transaction is to be treated and is often the subject of ATO scrutiny.

The ATO has warned taxpayers about the trap of claiming deductions for what appear to be lease payments when in fact the finance arrangement is a hire purchase or similar type of transaction. The only way to identify the difference is to read the terms and conditions of the finance agreement.

The ATO will consider a finance arrangement to be a lease when:

■ there is no option to purchase the vehicle written into the agreement, and

■ the residual value reflects a bona fide estimate of the vehicle’s market value at termination.

If these two conditions are not met, the ATO considers the finance agreement to be a hire purchase or other instalment type agreement.

Under a leasing arrangement, the lease payments are a deductible amount to the extent the vehicle is used for income producing purposes, and the financed sum is not typically booked on the balance sheet of the entity.

Hire purchase

This is simply another form of finance. Its tax and GST treatment however is vastly different from both that of leasing and acquisition by chattel mortgage. As a result, this form of finance needs to be considered on its own merits.

In essence, a hire purchase arrangement is an agreement to purchase goods by instalments. The term hire purchase is defined as:

“ a contract for the hire of goods where:

i) the hirer has the right or obligation to buy the goods; and

ii) the charge that is or may be made for the hire, together with any other amount payable under the contract (including an amount to buy the goods or to exercise an option to do so), exceeds the price of the goods; and

iii) title in the goods does not pass to the hirer until the option to purchase is exercised; or

iv) where title in the goods does not pass until the final instalment is paid”.

Unlike a lease, where there is no obligation to acquire the goods at the end of the instalment period, a hire purchase arrangement provides for this obligation and as such the goods will be eventually owned by the purchaser.

Chattel mortgage

A chattel mortgage from the perspective of recording the asset purchase and recognising the liability is identical to that of a hire purchase arrangement. The difference between a chattel mortgage and other forms of finance such as hire purchase and lease comes when dealing with the GST consequences.

Not sure? Please contact us if you would like to discuss your options and the tax consequences.

Upcoming trust distribution strategies –latest developments

If you run your business through a family trust, there’s some good news on the distribution front.

In mid-April, the ATO responded to the landmark trust distribution case, namely the Guardian AIT appeal ruling in January by the Full Federal Court, with a decision impact statement that where the ATO concedes that it will have to amend its position on trusts, section 100A of the Income Tax Act and reimbursement agreements. In the Guardian appeal, the Full Federal Court rejected the ATO’s position that a reimbursement agreement existed in the Guardian case and so section 100A did not apply.

To recap, the ATO in February 2022 updated its guidance around trust distributions made to adult children, corporate beneficiaries and entities that are carrying losses. Depending on the structure of these arrangements, potentially the ATO may take an unfavourable view on what were previously understood to be legitimate trust distribution arrangements. The ATO is chiefly targeting arrangements under section 100A, specifically where trust distributions are made to a low-rate tax beneficiary, but the real benefit of the distribution is transferred or paid to another beneficiary usually with a higher tax rate. In this regard, the ATO’s Taxpayer Alert (TA 2022/1) illustrates how section 100A can apply to the quite common scenario where a parent benefits from a trust distribution to their adult children.

Moving forward, there are a number of tax-effective strategies that can be employed that will not fall foul of the ATO’s interpretations in this area including:

■ Only distribute to Mum and Dad

This would be quite safe from section 100A scrutiny. No person pays less tax as a result of any agreement, and this is unlikely to be seen as high-risk by the ATO.

■ Continue to distribute to young adult beneficiaries, but hand over the money

If you are happy to give money to your children, this can be achieved while at the same time optimising tax.

■ Charge board and current university fees

If adult beneficiaries are living at home, they should pay board (just as if they had a job). This will not add up to large sums, but arm’s-length board for a full year could come to about $18,000. This allows for some tax arbitrage without handing the kids any money.

■ Use of bucket company

Having a private corporate beneficiary caps the tax rate imposed on trust income. Franked dividends can subsequently be flexibly allocated through having a trust structure interposed between the bucket company and the beneficiaries. The present entitlement can be lent back to the trustee for use in the business of the trust, although there are minimum repayment conditions. Avoid having the main trust as a shareholder in the bucket company.

The ATO considers circular income flows to be high-risk.

■ Be alert for the “no reimbursement agreement” argument

If you are contemplating making a gift or an interest-free loan to another person, ask questions about the circumstances behind this plan. If it was not in contemplation at the time of the relevant appointment of trust income (up to two years ago), but has arisen because family circumstances have changed recently, there may not be a reimbursement agreement.

■ If making gifts, go once and go big.

There are also other slightly bolder strategies.

If you operate your affairs through a discretionary trust, chat with us around your distribution options prior to the 30 June deadline.

New reporting arrangements for SMSFs from 1 July 2023

From 1 July 2023, trustees and directors of SMSFs must report certain events that affect their members transfer balance account quarterly.

These events must be reported by lodging a ‘transfer balance account report’ (TBAR) no later than 28 days after the end of the quarter in which they occur.

The purpose of this change is to streamline the reporting process and bring all SMSFs under a single reporting framework. This means there will no longer be an ‘annual reporter’ option.

What is a transfer balance account and a TBAR event?

The introduction of a transfer balance cap (TBC) from July 2017 introduced a limit on how much an individual could transfer from their superannuation accumulation account into a retirement phase pension. In order to track an individual’s use of their TBC, a ‘transfer balance account’ (TBA) is created to record necessary transactions from the time an individual first commences a retirement phase pension.

Importantly, a TBAR is only required when a member has an event which affects their TBA. The most common reporting events include:

■ Commencement of a pension

■ Lump sum withdrawals from a pension account

■ Commencement of a death benefit pension.

For many SMSFs, the members will have only one or two TBAR events in their lifetime.

Other events that do not affect a member’s TBA and therefore do not need to be reported include:

■ Pension payments

■ Investment earnings or losses

■ When an income stream ceases because the capital has been depleted

■ Death of a member.

Changes from 1 July 2023

From 2023/24 onwards:

■ A member’s total superannuation balance will no longer be relevant in determining whether an SMSF reports on a quarterly or annual basis, and

■ All SMSFs must lodge a TBAR within 28 days after the end of the quarter in which the TBC event has occurred (ie, by 28 January, 28 April, 28 July, and 28 October).

The new TBAR timeframes will therefore be due from1 July 2023 as follows:

This means that SMSFs that have previously been permitted to lodge a TBAR on an annual basis will no longer be permitted to do so from 1 July 2023.

However, the obligation for SMSFs to report earlier will remain in cases where a fund must respond to a pension excess transfer balance determination or a commutation authority from the ATO.

Action items for SMSF trustees

For those SMSFs that already report on a quarterly basis, there will be no change to the reporting frequency for TBAR events.

The changes impact SMSFs that are annual reporters only.

Note, if you’re currently lodging your TBAR annually at the same time as your SMSF annual return, you will need to report all events that occurred in the 2023 financial year by 28 October 2023.

Should you have any questions on your TBAR reporting obligations, please contact us today as we can help you prepare for these upcoming changes.

Click here to view Glance Consultants May 2023 newsletter via PDF