Trust distribution landscape now more settled

If you carry on your business affairs through a trust structure, there is now more clarity around the law on distributions following much uncertainty throughout the year.

Neither the taxpayer, Mr. Springer, nor the Commissioner has appealed against the Full Federal Court decision handed down in January 2023 (Commissioner of Taxation v Guardian AIT Pty Ltd ATF Australian Investment Trust [2023] FCAFC 3).

Readers will recall that the Full Court ruled against the Commissioner on the section 100A issue, but upheld his Part IVA determination for the 2013 year on the basis that the taxpayer had not demonstrated that absent the scheme (involving a distribution to a corporate beneficiary that was paid back to the trust as a franked dividend and on-paid to the non-resident, Mr. Springer, without any top-up tax) the trust would have done something other than making a distribution directly to Mr. Springer.

The Commissioner was unsuccessful with his Part IVA appeal for the 2012 year, when events were still said to be evolving.

Mr. Springer may well have decided he’s done well enough, having succeeded in challenging all but one of the income years attacked by the Commissioner.

The Commissioner may have been disappointed with the section 100A outcome, but will probably rationalise the decision on the basis that it turned very much on its own facts – at the time the 2013 resolution was made to appoint trust income there was no certainty that the corporate beneficiary would pay a franked dividend back up to the trust.

But he would have been quite pleased with the Part IVA result, which confirms that the 2013 amendments have been effective in disposing of the “do nothing” alternative postulate that was successfully relied upon by RCI, News Corp and Futuris.

The legal and practical upshot of the Part IVA decision is that taxpayers can now be taxed on notional transactions with a very high tax cost that they would not have contemplated entering into in a million years. Just goes to show that taxpayer success in the courts can be undone by the stroke of a legislative pen.

The Full Federal Court ducked the issue of the ordinary dealing exception, which it was entitled to do, given its conclusion that there was no reimbursement agreement. But that outcome is regrettable at a broader level. Absent further guidance from the Full Court, we are left with some encouraging comments from Logan J at first instance (about the lack of artificiality) which the Commissioner reads down in TR 2022/4.

Hopefully the Full Court’s decision in a case known as BBlood, expected later this year, will shed further light on the issue. Given the decision at first instance, it seems unlikely the taxpayer will succeed on the ordinary dealing question in that case. However, the appeal decision may include some helpful guidance from the Full Court, even if the taxpayer is unsuccessful.

In the meantime, 30 June is rushing towards us, and family trusts need to be considering their position in relation to upcoming trust resolutions. Chat with us to establish your distributions for this year which may be governed, among other things, by your appetite for risk within the confines of the law.

Proposed tax on $3m super balances

Individuals with large superannuation balances may soon be subject to an extra 15% tax on earnings if their balance exceeds $3m at the end of a financial year.

What has been proposed?

Recently, the government announced it will introduce an additional tax of 15% on earnings for individuals whose total superannuation balance (TSB) exceeds $3m at the end of a financial year.

Those affected would continue to pay 15% tax on any earnings below the $3m threshold but will also pay an extra 15% on earnings for balances over $3m.

The proposal will not impose a limit on superannuation account balances in the accumulation phase, rather it is about how generous the tax concessions are on higher balances.

The government has confirmed the changes will not be applied retrospectively and will apply to future earnings, coming into effect from 1 July 2025. This means your balance in superannuation at 30 June 2026 is what matters initially.

What counts towards the $3m threshold?

The $3m threshold is based on your total superannuaton balance (TSB) and includes all of your superannuation accounts. This includes your accumulation and pension accounts and all superannuation funds you may have (such as your SMSF and any APRA-regulated superannuation funds you have).

Further, the $3m threshold is per member, not per superannuation fund. This means a couple could have just under $6m in superannuation/pension phase before being impacted by the proposals.

How will earnings be calculated?

Put simply, the extra 15% tax is unrelated to the actual taxable income generated by your superannuation fund. Rather, it is a tax on earnings or increases in account balances over $3m (including unrealised gains and losses).

This means any growth in balances will include anything that causes your account balance to go up – such as interest, dividends, rent, and capital gains on assets that have been sold, including any notional or unrealised gains on assets that increase in value, even if your fund hasn’t sold them.

Apart from the extra 15% tax, the taxation of unrealised gains is what has caused a stir, as currently individuals do not pay tax on income or capital gains on assets that have not been sold.

When looking at how to capture growth in a person’s TSB over a financial year, earnings will be calculated based on the difference in TSB at the start and end of the financial year, and will be adjusted for withdrawals and contributions.

It is also worth noting that negative earnings can be carried forward and offset against this tax in future years’ tax liabilities.

How is the extra 15% tax calculated?

Superannuation funds, including SMSFs, will not be required to calculate the earnings attributable to a member’s balance above $3m.

Rather, the ATO will use a three-step formula to calculate the proportion of total earnings which will be subject to the additional 15% tax.

How will the extra tax be paid?

Individuals will be notified of their liability to pay the extra tax by the ATO. This means the ATO, not their superannuation fund, will issue members with a tax assessment.

Individuals will have the choice of either paying the tax themselves or from their superannuation fund(s) (if they have multiple funds).

The tax will be separate to the individual’s personal income tax liabilities.

Don’t fret just yet

The measure is due to start from 1 July 2025, so superannuation funds and members still have time to consider their options.

Remember, this measure is still a proposal and must be passed into legislation by Parliament to become law. So don’t rush to remove benefits below the $3m limit just yet as once amounts have been withdrawn from superannuation, it’s hard to get them back in.

If you have any questions or would like to discuss this proposal in further detail, please contact us for a chat.

FBT exemption for electric vehicles

With car fringe benefits one of the most common benefits provided by employers to employees, a new ATO fact sheet shines more light on the FBT exemption for electric vehicles.

To recap, in the October 2022 Federal Budget, the government announced that it would exempt from FBT the private use, or availability for use, of cars to current employees that are zero or low emissions vehicles with a value at first retail sale below the luxury car tax threshold for fuel efficient vehicles. This is aimed at making electric cars more affordable, to encourage a greater take-up of electric cars by Australian road users to reduce Australia’s carbon emissions from the transport sector.

The new law applies to fringe benefits provided on or after 1 July 2022 for cars that are eligible zero or low emissions vehicles that are first held and used on or after 1 July 2022 (see examples 1 and 2 in the fact sheet).

To be clear, the new rules apply to cars that are collectively referred to as zero or low emissions vehicles, namely:

■ battery electric vehicles

■ hydrogen fuel cell electric vehicles, and

■ plug-in hybrid electric vehicles.

For such vehicles, an FBT exemption should normally apply where both: the value of the car is below the luxury car tax threshold for fuel efficient vehicles ($84,916 for the 2022/23 financial year), and the car is both first held and used on or after 1 July 2022.

From 1 April 2025, private use of a plug-in hybrid EV is no longer eligible for the exemption unless:

(i) use of the plug-in hybrid electric vehicle was exempt before 1 April 2025; and

(ii) the employer has a financially-binding commitment to continue providing private use of that vehicle on and after 1 April 2025.

Other key points in the facts sheet are:

■ An FBT exemption may apply to a car benefit arising if either:

– you allow your current employees, or their associates, to use a zero or low emissions vehicle (electric vehicle) for their private use, or

– the electric vehicle is considered available for your current employees’, or their associates’, private use under FBT law.

■ If an employer or lessor provides an employee with the use of a car by means of a lease arrangement, the benefit provided is only a car benefit if the car lease arrangement is a bona fide car leasing arrangement.

■ Associated benefits arising from the provision of certain car expenses provided with the electric vehicle are also exempt from FBT. These are not included when working out if an employee has a reportable fringe benefits amount. These benefits may be provided as an expense payment, property or residual benefit, and include: registration and road user charges, insurance, repairs and maintenance and fuel (including electricity to charge and run electric vehicles).

■ Providing your employee with a home charging station is a fringe benefit – the benefit is not an exempt associated benefit.

■ If the use of the car and the associated car expenses are provided under a salary sacrifice arrangement, the exemption can still apply.

■ Even if an exemption applies for the electric vehicle car benefit, you still need to work out the taxable value of the car benefit provided. This is because the car benefit’s value is used in working out if the employee has a reportable fringe benefits amount. This does not include the value of any associated car expense benefits.

■ An employee’s reportable fringe benefits amount is reported on their income statement or payment summary. Employees do not pay income tax on this amount, but it does impact their income tests and thresholds for family assistance, child support assessments and some other government benefits and obligations.

■ The government will complete a review of this exemption by mid-2027 to consider electric vehicle take-up.

Touch base with us, for more information about this new FBT exemption.

Reducing the risk of crypto scams

ASIC has released fresh and timely information around crypto scams.

Scammers use cryptocurrencies, like bitcoin or ether, because they are not easily recovered.

Crypto can be sent overseas quickly with limited oversight. If you lose your money to a crypto scam, your money is likely gone. If you buy crypto, only invest what you can afford to lose as it’s a somewhat volatile investment.

How to spot a crypto scam

If you’re investing in crypto, watch out for these potential red flags:

1. Unexpected contact

Someone you don’t know contacts you with investment advice or offers:

■ through phone, email, social media or text message

■ claiming to be an investment manager or broker

■ through an online forum discussing crypto.

2. Recommendations from someone familiar

You may hear about it through:

■ an advertisement or fake celebrity endorsement on social media

■ an online influencer promoting a token and claiming to have made huge, quick profits

■ family and friends who have unknowingly been scammed themselves

■ an online romantic partner who asks for money paid in crypto or suggests an investment opportunity.

3. Pressure to take action

You are being pushed to:

■ transfer crypto off your current exchange and invest through their site

■ use crypto to pay an individual or for a financial service

■ download an investment app not listed on Google Play Store or Apple Store

■ deposit money to invest into different bank accounts

■ pay tax or invest more in order to access your funds.

4. Something just doesn’t feel right

You’re not sure about:

■ the crypto investment offers “guaranteed” high returns or “free” money

■ crypto service providers that withhold investment earnings for “tax purposes”

■ strange tokens appear in your digital wallet that you did not trade yourself

■ there is little paper trail for crypto investments you make

■ the document describing the crypto investment (sometimes called a “whitepaper”) is poorly written or non-existent

■ online searches indicate that an entity may be a scam or has bad reviews

■ a work from home job offer that requires you to purchase cryptocurrency.

How crypto scams work

There are three main types of crypto scams:

1. Investing in a fake crypto exchange, website or app

Scammers create fake crypto trading apps to steal your money. The giveaway is usually that they ask you to download the app from their website. They may appear on legitimate platforms like Google Play and Apple, but are usually promptly removed. If you find one on an app store, check for overly positive reviews and be cautious.

2. Fake crypto tokens, investments or jobs trading crypto

■ Scam tokens in crypto wallets – A mystery token appears in your crypto wallet, seemingly worth thousands. If you sell it, a “smart contract” is activated. This transfers your legitimate crypto tokens and private keys to the scammer.

■ Crypto ponzi scheme – You are promised large “returns” by investing in crypto. But the promoter uses money from other investors to pay your “earnings”.

■ Jobs “trading crypto” – You apply for a job ad for “crypto traders”, for a fake or impersonated financial services firm. You are told to set up multiple bank and crypto accounts, and are paid well for a few hours of work a week. You think you’re trading crypto for the entity’s “investors” or “clients”, but you’re actually money laundering for the scammers. You could be charged by state or federal police.

3. Using crypto to pay scammers

■ Requests for payment in crypto – An online romantic partner, job recruiters, work from home job, or fake financial services firm asks for payment in crypto only.

■ Giveaway scams – Fraudulent posts on social media offer to match or multiply crypto invested with them in a crypto giveaway scam. Often, this uses fake celebrity endorsement.

■ Blackmail/extortion – You’re told by a scammer they have your internet browsing history, compromising photos or videos. They demand payment in crypto.

Take-home message

If you’re uncertain whether you’re being scammed by an unsolicited contact, keep your powder dry and abstain from acting. Contact your advisors before acting.

Fending off GST audits

The Government has welcomed the actions of an ATO-led taskforce in relation to what is termed “the biggest GST fraud in Australia’s history”.

The ATO states that the fraud was first detected in early 2022 and involved offenders inventing fake businesses and ABN applications, then submitting fictitious Business Activity Statements in an attempt to gain a false GST refund. In response, the ATO’s Serious Financial Crimes Taskforce set up “Operation Protego” in partnership with the Australian Federal Police.

Warrants were executed in three States against ten individuals suspected of promoting the fraud (which included the use of social media).

Some of the numbers involved are simply staggering in terms of the perpetrators’ audacity:

■ The ATO has taken compliance action on more than 53,000 “clients”.

■ It has stopped approximately $2.5 billion in fraudulent GST refunds from being paid (as at 31 December 2022).

■ Two individuals have been sentenced to jail following their arrest in 2022.

■ There have been some 87 arrests across the country, “with many more to come”.

■ The ATO has commenced writing to more than 20,000 individuals involved in the fraud.

The purpose of our informing clients of this operation goes to GST audits conducted by the ATO and what they will be looking for should you or your business be selected. As a starting point, generally, the ATO will apply at least some level of scrutiny to Activity Statements where there is a refund of $5,000 or more or where the refund is uncharacteristically large for the taxpayer involved.

The key to staving off a GST audit is the obtaining and retaining of tax invoices. As your tax agent, there is no requirement for us to view each and every tax invoice you hold before we make a claim for GST credits on your behalf on your Activity Statement.

However, no claim can be made without you being in possession of a tax invoice.

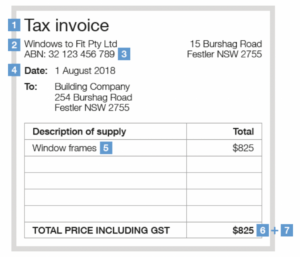

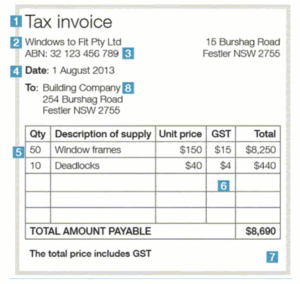

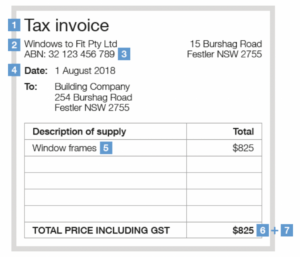

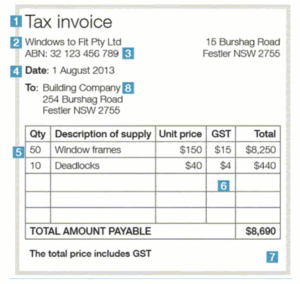

Tax invoices for purchases of less than $1,000 must include enough information to clearly determine the following seven details:

1. the document is intended to be a tax invoice

2. seller’s identity

3. seller’s Australian business number (ABN)

4. date the invoice was issued

5. brief description of the items sold, including the quantity (if applicable) and the price

6. GST amount (if any) payable – this can be shown separately or, if the GST amount is exactly one-eleventh of the total price, as a statement which says “Total price includes GST”

7. extent to which each sale on the invoice is a taxable sale.

Tax invoices for sales of $1,000 or more also need to show the buyer’s identity or ABN.

The following example shows:

■ GST included in each line item

■ the sale is clearly identified as being fully taxable by the words “Total price includes GST”

■ the buyer’s identity for sales of $1,000 or more.

If you have any questions around tax invoices, or if you are having problems obtaining them, reach out to us.

Lost super

Did you know there is around $16 billion in lost and unclaimed superannuation across Australia? The ATO recently indicated this is an increase of $2.1 billion since last financial year and is urging Australians to check their account to see if some of the money is theirs.

How to find lost or unclaimed super

Finding lost or unclaimed superannuation is easy and can be done in a matter of minutes. To find and manage your superannuation using ATO online services:

■ Sign in or create a myGov account

■ Link your myGov account to the ATO

■ Select “Super”.

You can then find and consolidate your super.

Alternatively, if you are unable to access ATO online services, you can call the ATO’s lost super search line on 13 28 65. You will need to provide information such as your personal details, contact details and superannuation fund details.

Who can have lost super?

People often lose contact with their superannuation funds when they change their job, name, address, live overseas, or simply forget to update their details.

Lost super is superannuation money held by superannuation funds. You become a “lost member” and your superannuation becomes “lost” if you are:

■ Uncontactable – the fund has lost contact with you and your account hasn’t received a contribution or rollover for at least 12 months

■ Inactive – your account hasn’t received a contribution or rollover in five years.

Your fund will hold your lost super until they find you.

If they can’t find you, some types of lost super will be transferred to the ATO.

Who can have unclaimed super?

Unclaimed super is money funds are required to transfer to the ATO twice a year.

Generally, super will be transferred to the ATO from superannuation providers for any of the following:

■ Unclaimed super of members aged 65 years or older, non-member spouses and deceased members

■ Superannuation of former temporary residents who have left Australia for six months or more and their visa has expired

■ Small lost member accounts (with balances of less than $6,000)

■ Insoluble lost member accounts (ie, lost accounts which have been inactive for a period of five years and have insufficient records to ever identify the owner of the account)

■ Inactive low balance accounts

■ Accounts held in eligible rollover funds that were transferred to the ATO before they wind up

■ Amounts your fund transferred to the ATO on a voluntary basis when they determine that it is in your best interest.

Don’t wait, start looking!

Superannuation is one of the most important investments many Australians will have during their lifetime. Make sure you search for any lost or unclaimed super you may have as bringing it all together may help you save on fees and will also make it easier to manage your retirement savings.

For information on how to manage your superannuation and view all your superannuation accounts, including lost and unclaimed super in myGov, contact us today.

Click here to view our Glance Consultants newsletter via PDF