The Federal Government has announced some key changes to the superannuation system that will take effect from 1 July 2024.

Key changes include an increase in the concessional and non-concessional contribution caps, the bring forward caps, and the total superannuation balance thresholds that apply to determine the maximum amount of bring forward non-concessional contributions available to members.

Concessional and non-concessional contribution caps

The announcement includes an increase in the standard concessional and non-concessional contribution caps, which determine how much money can be put into super each year with lower tax rates.

The concessional contribution cap, which applies to employer and salary-sacrificed contributions, as well as personal contributions claimed as a tax deduction, will increase from $27,500 to $30,000. This can mean that superannuation fund members can reduce their taxable income by contributing more to their super.

The non-concessional contribution cap (NCC), which applies to after-tax contributions, will increase from $110,000 to $120,000. This can mean that superannuation fund members can add more to their superannuation balance from their own savings or inheritances, without paying extra tax.

This is the first time the contribution caps have been increased in three years.

Non-concessional contribution cap and the bring forward rule

The increase to the NCC cap under the bring forward rules will not apply to clients who have already triggered the “bring forward rule” in either this income year (ending 30 June 2024) or last year (ended 30 June 2023). Both of these income years are still within their bring forward period.

From 1 July 2024, the maximum NCC cap under the bring forward rules will be increased from $330,000 to $360,000 (which is three times $120,000).

Members wanting to maximise their NCCs using the bring forward rule may want to consider keeping any NCCs this year (ending 30 June 2024) under the current $110,000 limit. Then after 1 July 2024, trigger the bring forward rule with the higher $360,000 limit, which could allow a member to get an additional $30,000 of NCC into their superannuation fund.

We note that the NCC bring forward rule is available to members that are under age 75 (67 prior to 1 July 2022), which means that individuals under age 75 in the income year in which they make a NCC can bring forward up to three times their annual NCC, provided that they meet the relevant conditions.

Total superannuation balance

Another change is the limit for total superannuation balance and transfer balance for members with no existing pension. The total superannuation balance is the amount of money a person has in all their super accounts, while the transfer balance is the amount of money a person can move from their super account to a retirement income stream, such as an account-based pension.

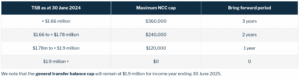

From 1 July 2024, the total superannuation balance (TSB) thresholds, used to determine the maximum amount of bring-forward NCCs available to an individual, will be adjusted as follows: