Stage 3 tax cuts: A tax saving opportunity?

Legislation giving effect to the government’s revised settings for the Stage 3 tax cuts has been passed by both houses of Parliament with the support of the Coalition.

The stage 3 tax cuts changes:

■ reduce the 19% tax rate to 16% for incomes between $18,200 and $45,000

■ reduce the 32.5% tax rate to 30% for incomes between $45,000 and the new $135,000 threshold

■ increase the threshold at which the 37% tax rate applies from $120,000 to $135,000, and

■ increase the threshold at which the 45% tax rate applies from $180,000 to $190,000.

A permanent tax saving

Many taxpayers and their advisers focus on timing issues around year-end by deferring income and bringing forward deductions. Legitimate steps can be taken to shift taxable income from one year to the next and most people would prefer to pay tax next year rather than this year. However, any benefit gained reverses in the following year when you have to do it all again just to stand still. It’s a lot of effort for a once-off timing advantage.

The difference with the 1 July 2024 tax rate changes is that reducing your taxable income in 2023-24 and increasing it in 2024 25 (where it is taxed at a lower rate) produces a permanent saving over the two- year period – a saving you get to keep. That may make such timing issues worth another look.

How much can you save?

That depends on your where you sit on the income scales and how much taxable income is shifted. Very high income earners will have a marginal tax rate of 45% regardless of whether they shift income and deductions around, and those on lower incomes don’t pay much tax to begin with, so their potential savings are less.

But for anyone who expects to fall in the taxable income range of $120,000 to $135,000, for example, there is a permanent saving of 7% on up to $15,000 in taxable income that is shifted from 2023-24 into 2024-25.

Take someone in that income range who owns a rental property which is in need of a $15,000 paint job and who was planning to get it done by Christmas. They could save themselves $1,050 by arranging to have the job done in May or June. Not a fortune, but not chickenfeed either.

So, how can you go about shifting taxable income into 2024-25?

Before looking at various options, it is necessary to point out that the tax laws include anti-avoidance rules that prevent tax planning strategies which have as their sole or dominant purpose the gaining of a tax advantage. However, if you are simply bringing forward ordinary business-related purchases that you would have made anyway, those rules are unlikely to be triggered. To make certain you stay on the right side of the tax rules you should check with us before taking any action.

Bringing deductions forward

Subject to that necessary reservation, and depending on your expected taxable income, bringing deductions forward into the 2023-24 income year offers the widest range of options for achieving a permanent tax saving. Bear in mind that bringing purchases forward does involve an earlier than planned cashflow impact that you would need to fund. Options include:

Rental properties

If you have a rental property that is in need of any sort of maintenance or repairs, why not get on to it now? You’ll be bringing the deduction into 2023-24 and keeping your tenants happy at the same time. There can sometimes be a fine line between repairs (deductible immediately) and improvements (deductible over time). We can help you sort out which is which.

Gifts and donations

If you have a tradition of gifting and donating, maybe to telethons and appeals that occur later in the year, consider making those donations to the charities before the end of June 2024. Charities are more than happy to receive donations at any time of the year, and if the taxman can give it an extra boost, why not? Double check that your chosen charity is a deductible gift recipient.

Superannuation

Consider making after-tax contributions into your super fund. But be mindful of contribution caps and the additional 15% tax on contributions made by high income earners. You should seek financial advice prior to taking any action.

Sole traders and partnerships

Do you have a small business which you operate through your own name or in partnership? Consider some of these possibilities:

■ Depreciation: Could you do with a new laptop or other tools and equipment? Or even a modest motor vehicle? Legislation that is expected to pass Parliament before 30 June 2024 will set the small business threshold for claiming an outright deduction for the cost of depreciating assets to $20,000. If you’re planning to make these purchases anyway, you would be better off with that sort of deduction falling into the 2023-24 year where the tax rate is higher. So consider paying a visit to JB Hi-fi, Bunnings or the nearest car yard and start looking around.

■ Bad debts: Have a receivable you know isn’t going to pay, but you just haven’t wanted to admit it? Consider writing it off and take the deduction now. But remember, the debt must be more than simply doubtful and there are certain other requirements which must be met. We can help you with those.

■ Obsolete stock: Is that box of polaroid cameras really going to move anywhere other than to a museum? Write it out of stock before 30 June 2024 and take the deduction.

■ Bring forward deductible expenses: Buying two boxes of printer paper? Buy three instead. Stock up on printer ink, you never know when you’re going to have that big print run you hadn’t anticipated. Consider what other consumables you use and stock up for your short-term needs before 30 June 2024.

■ Prepay deductible expenditure: All taxpayers are entitled to claim deductible prepaid expenditure where the expenditure is below $1,000 (excluding GST) or the expenditure is required by law (e.g., car registration fees). Where the expenditure is $1,000 or more, small business entities can deduct the full amount of prepaid expenditure if it relates to a period of 12 months or less. Note that this is also available to non-business expenditure of individuals (e.g., work-related expenses or rental property expenses).

■ Employee bonuses: Confirm commitments to pay employee bonuses are made by 30 June 2024, and don’t forget that PAYG withholding must be withheld when the bonuses are paid.

■ Skills and training: Take advantage of the small business entity skills and training boost before it ends on 30 June 2024. The Boost enables small businesses to deduct an additional 20% of expenditure that is incurred for the provision of eligible external training courses to their employees by registered providers in Australia.

■ Energy incentive: Take advantage of the small business entity energy incentive which provides a bonus deduction of 20%. Eligible assets include heat pumps and electric heating or cooling systems, and demand management assets such as batteries or thermal energy storage. Eligible assets or upgrades will need to be first used or installed ready for use by 30 June 2024.

Note: this incentive is provided for in the same Bill as the $20,000 instant asset write-off provisions, which is currently before Parliament and is expected to pass before 30 June 2024.

Deferring income

Options for shifting income into the 2024-25 year are more limited, but include:

Salary sacrifice

Consider salary sacrificing into super before 30 June 2024. As mentioned above, be mindful of the contribution caps, the additional tax for higher income earners and seek financial advice before taking any action.

Interest

Ensure term deposits mature after 30 June 2024.

We are here to help you work through any of these options.

Don’t forget the CGT small business rollover

For those who run a “small business” and decide to sell it, the various Capital Gain Tax (CGT) small business concessions are invaluable (as has been noted many times before).

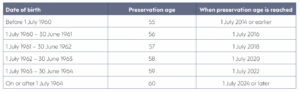

Of course, it is great if you can qualify for the “15-year exemption” concession because this will mean that you won’t have to pay any CGT. But this requires, among other things, that you are aged 55 years or over and are “retiring in connection” with the sale, something that may just not be the case.

But if this is not the case, you may still be able to use the retirement exemption to eliminate up to $500,000 of capital gain.

However, if you are under 55 years of age at the time of the sale of the business then any qualifying capital gain must be paid into your super. You cannot take it directly. On the other hand, if you are 55 years or older you can take it directly without having to pay it into super and spend it as you wish.

But like the “15-year exemption” there are a number of hoops to jump through, especially if the capital gain has been made by a company or family trust you control. And these hoops relate to making the payment of the CGT exempt amount to you in the appropriate manner.

As a last resort, you can use the roll-over in the CGT small business concessions to acquire a replacement asset. However, if a replacement asset is not acquired within two years then the capital gain is reinstated and taxed at that time.

But this concession is far more than “a last resort”.

In fact, it is a significant (and acceptable) planning device in its own right. Furthermore, it can be used from the start in relation to the whole of the capital gain so that all its benefits can be fully utilised.

And these benefits include the ability to defer the assessment of the gain for up to two years to, say, allow time for you to turn 55 years of age so that you can then use the retirement exemption to take the capital gain CGT-free.

It can also be used to buy you time to meet other relevant conditions to qualify for the retirement exemption – so that when the rolled over gain is reinstated after two years you can then apply the retirement exemption to your benefit. This may be relevant where, for example, the capital gain was made by a family trust, and you need to find a “controller”of the trust in order to use the exemption.

And if nothing else, the rollover can give you an extra two years just to think what you are going to do about things, including whether just to do the obvious and buy a replacement business asset (of any type) in the meantime.

So, once again, the advice of your accountant is invaluable in the matter of whether to buy a replacement asset or when (and how) it is best to realise your capital gain.

Super contribution caps to increase on 1 July

For the first time in three years, the superannuation contributions are set to increase from 1 July 2024.

CONTRIBUTION CAPS TO INCREASE

Due to indexation, the contribution caps will increase on 1 July 2024 as follows:

■ Concessional contributions cap – from $27,000 to $30,000

■ Non-concessional contributions cap – from $110,000 to $120,000

■ The maximum non-concessional contributions cap under the bring forward rules – from $330,000 to $360,000

WHAT ARE CONCESSIONAL CONTRIBUTIONS?

Concessional contributions (CC) are before-tax contributions and are generally taxed at 15%. This is the most common type of contribution individuals receive as it includes superannuation guarantee (SG) payments your employer makes into your fund on your behalf. Other types of CCs include salary sacrifice contributions and tax-deductible personal contributions.

The government sets limits on how much money you can add to your superannuation each year. Currently, the annual CC cap is $27,500 in 2023/24.

WHAT ARE NON-CONCESSIONAL CONTRIBUTIONS?

Non-concessional contributions (NCC) are voluntary contributions you can make from your after-tax dollars. For example, you may wish to make extra contributions using funds from your bank account or other savings.

As such, NCCs are an after-tax contribution because your employer has already taken out the tax you need to pay on your income. Currently, the annual NCC cap is $110,000 in 2023/24.

WHAT ARE THE BRING FORWARD RULES?

The bring forward rules apply to NCCs and allow you to make up to three years of NCCs in a single financial year, if you’re eligible. This means you can put in up to three times the annual cap of $110,000, which means you may be able to top up your superannuation by $330,000 within the same financial year.

Using the bring forward rules can be beneficial for individuals who have a large amount of cash to contribute which may have come from an inheritance or from the sale of an asset/property.

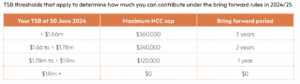

However, how much you can make as a NCC will depend on your total superannuation balance (TSB) as at 30 June of the previous financial year (see table below).

BRING FORWARD NCC AMOUNTS WILL ALSO INCREASE

In addition to the contribution caps increasing, the maximum NCC cap under the bring forward rules will also increase on 1 July 2024.

The table below shows the TSB thresholds that apply to determine how much you can contribute under the bring forward rules.

TAKE CARE BEFORE YOU CONTRIBUTE

The increase to the NCC cap under the bring forward rules will not apply to individuals who have already triggered the bring forward rule in either this year (2023/24) or last year (2022/23) and are still in their bring forward period. This is because the NCC cap that applies to an individual is calculated with reference to the standard NCC cap when they triggered the bring forward rule in their first year.

For example, if the NCC cap in the second and third year of a bring forward period changed to $120,000 due to indexation, your NCC cap will still be $330,000 ($110,000 x 3 years) and not $350,000 ($110,000 + $120,000 + $120,000).

For this reason, if you want to maximise your NCCs using the bring forward rule, you may wish to consider restricting your NCCs this year to $110,000 or less so you do not trigger the bring forward rule this year.

However, how much you can contribute and whether your fund is allowed to accept your contribution can depend on your age, your TSB and other eligibility criteria. The rules are complex and making contributions to superannuation that exceed the contribution caps can result in excess tax.

Give us a call if you need any further information or would like to chat about your options.

Briefing a barrister

When you’re faced with a complex or high-risk question in tax or super, briefing a barrister can provide you with the expertise and perspective to help you move towards a solution with confidence.

Barristers (who are also referred to as “counsel”) are independent specialists in court work and legal advice. There are specialist barristers across Australia in tax, super and associated areas of law.

This includes “King’s Counsel” or “Senior Counsel”, who are barristers of seniority and eminence.

The barristers who practice in tax and super will particularly be familiar with the ATO, and also the decision-making approaches of the Administrative Appeals Tribunal (AAT) and the Federal Court of Australia.

Why brief a barrister?

Although barristers are best known for their courtroom advocacy, that’s only part of what they offer. Barristers, through their training, experience and networks, are intimately familiar with the decision-making processes and reasoning of courts and tribunals. When barristers address complex and high-risk legal questions, they provide precise advice and practical solutions guided by how laws are interpreted and applied by courts and tribunals in practice.

You may consider briefing a barrister to provide advice on high-risk or high-value matters, or when you have limited time to answer a complex question. In those situations, it’s prudent to obtain specialist advice to ensure you fulfill your duties.

A barrister’s expertise and objectivity will provide you with confidence as to the best approach in the circumstances.

Who can brief a barrister?

Anyone can brief a barrister. There are broadly two ways you can do it:

■ directly (where you brief a barrister without engaging a solicitor), or

■ indirectly (where you engage a solicitor and instruct them to brief a barrister).

Directly briefing a barrister (which is also referred to as “direct access” briefing) can provide you with cost and efficiency benefits. Generally, barristers are less expensive than solicitors of equivalent experience.

Barristers are not obliged to take direct briefs, but many do. Barristers may directly give legal advice and may prepare and advise on certain legal documents (in addition to their dispute-related work).

Importantly, barristers can be directly briefed to appear in the AAT.

There are slightly different rules in each Australian state and territory on the types of work that barristers can and can’t do, and the circumstances in which you can directly brief a barrister. Generally, barristers are not permitted to undertake work traditionally performed only by solicitors, such as conducting general correspondence or other administrative tasks in relation to the client’s legal affairs.

In some circumstances, barristers who have been directly briefed may later request that their client also engage a solicitor. This will occur where the absence of an instructing solicitor would seriously prejudice the client’s interests (for example, where a solicitor is needed to help the client gather large amounts of evidence).

Who should you brief?

As a starting point, the bar associations of each state and territory maintain a website where you can view and search the profiles of every barrister in that jurisdiction. On those websites, you’ll be able to identify the barristers who practice in tax and super and view their background, experience level and contact details. Just search for “bar association” in your state or territory.

If you’ve engaged a solicitor, they’ll be able to recommend a good barrister. If you want to brief directly, but you don’t know who to brief, you can obtain guidance from barristers’ clerks. The clerks act like an agent for a large group of barristers. The clerks have familiarity with the expertise, experience and availability of each barrister. The clerks’ contact details are also on the bar association websites.

Preparing a brief

Historically, a “brief” was a comprehensive set of papers given to a barrister to enable them to appear, advise, or draft or settle documents (as the case may be). Today, barristers are more versatile in what they receive from clients (and how they receive it).

If you’ve directly briefed a barrister, you should first speak to them about the nature and form of documents and information they require you to provide. For example, where you require tax advice on a legal question, your barrister may (depending on the circumstances) ask you to provide the following types of documents and information:

■ questions upon which you require legal advice

■ timeframes for the provision of that advice

■ identity of all parties involved in the subject matter of the advice

■ chronology of key events, and

■ key correspondence, contracts and other documents.

Barristers will also have their eye on ensuring their advice is commercially acceptable. For this reason, it is useful to also inform them about:

■ your purpose for engaging in relevant activities, and

■ any commercial issues likely to influence your preferred approach.

Some tips

If you’re going to brief a barrister, you should keep these tips in mind:

■ Brief early: This will give your barrister the opportunity to read the brief, understand your circumstances and seek out any further information.

■ Brief clearly: Precisely communicating what you want from your barrister (and when, how and why you want it) will provide you with the best outcome.

■ Brief orderly: Where you need to provide lots of documents, speak to your barrister about the form and categorisation in which they prefer to receive, store and use them.

Barristers offer you legal expertise from a practical perspective. You should visit the website for the bar association in your state or territory if you want further information about the role of barristers or if you want to find a barrister to help you.

Click to view our Glance Consultants March 2024 newsletter via PDF